Creel García-Cuéllar advises IDB Invest on social bonds emission

Creel García-Cuéllar has assisted IDB Invest on the issuance of social bonds that will finance gender-focused projects in Mexico

Mexican law firm Creel, García-Cuéllar, Aiza y Enriquez SC has advised IDB Invest on the issuance of social bonds aimed at empowering women by financing gender equality projects in Mexico, which would also be in sync with the United Nations Sustainable Development Goals.

Mexican law firm Creel, García-Cuéllar, Aiza y Enriquez SC has advised IDB Invest on the issuance of social bonds aimed at empowering women by financing gender equality projects in Mexico, which would also be in sync with the United Nations Sustainable Development Goals.

The $122 million dollars transaction closed on March 24, making it to this day, IDB Invest’s highest-ever bond issuance in Mexico.

The transaction is the first social bond issue by a multilateral development bank in Latin America to have a gender approach. It is also the second IDB Invest issuance within the framework of sustainable debt.

The issue received more than $3.8 billion dollars MXN, thanks to the support of 29 institutional investors. The bonds will expire in three years.

The proceeds received will be used by IDB Invest to help finance women-led SMEs that suffered the consequences of the covid-19 pandemic in Mexico.

The world’s first gender-focused social bonds were originated by IDB Invest, by issuing $100 million dollars from Colombia’s Banco Davivienda. The first Latin American corporate bond issuer to adhere to the UN Sustainable Development Goals was Mexican real estate developer Vinte, as of December 2020.

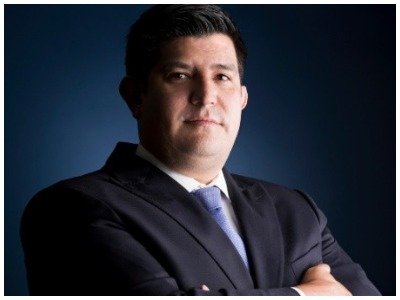

Creel, García-Cuéllar, Aiza y Enriquez team was led by partner Eduardo Flores Herrera (pictured) among with the associates Adriana Colliers Fuertes, Paola Kiehnle Barocio and Héctor Ávila Martínez