CTF Advogados is the new firm specializing in strategic litigation. Founded by Ricardo Chiavegatti, Wanessa Françolin, Daniel Teixeira, and Samanta Cantoli, the partnership brings together professionals who have worked side by side for nearly

Charneski Advogados introduced attorney Kaliane Abreu as a new partner at the firm with the mission of assisting in the expansion of operations in São Paulo. Founded by Heron Charneski in 2009, Charneski Advogados is

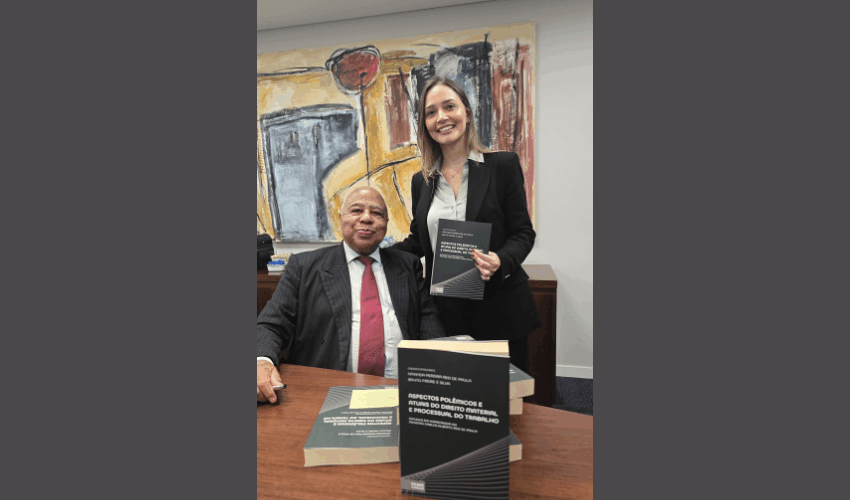

Peixoto & Cury Advogados announced the opening of its Brasília headquarters and the arrival of two new partners: former Minister and former president of the Superior Labor Court (TST), Carlos Alberto Reis de Paula,

Pinheiro Neto Advogados acted as deal counsel on the public offering of the first series of the twenty-sixth issuance of simple, non-convertible, unsecured debentures, issued by Vert Companhia Securitizadora, backed by Credit Rights owed by

Demarest Advogados announced two new partners in the areas of Banking and Intellectual Property, Technology, and Innovation. Senior lawyers Camila Garrote (Intellectual Property, Technology, and Innovation) and Fausto Teixeira (Banking and Finance) will join the

Kincaid Mendes Vianna Advogados announced the promotion of Verônica Estrella Holzmeister (pictured left) and Tarik Bergallo Kalil Jacob (pictured right) as new partners in the firm, which now has 10 partners. Both have been part

SBSA Advogados announced the arrival of Daniel C. Barbosa (pictured) to strengthen its practice in Public Law, with an emphasis on regulatory and punitive administrative law. With a career built at the intersection of law,

Pinheiro Neto Advogados acted as deal counsel on the 14th issuance of non-convertible debentures, unsecured, with additional fidejussory guarantee granted by Boticário Produtos de Beleza, in the amount of BRL 2 billion, divided into three

Freitas Ferraz Advogados advised Longati Capital Holding, a search fund focused on acquiring and managing Brazilian mid-market companies, on the acquisition of an equity stake in CAF Máquinas Indústria, a company renowned since

Lefosse advised Companhia de Eletricidade do Estado da Bahia – Coelba in its 22nd issuance of non-convertible debentures, in two series, in the total amount of BRL 3,3 billion, pursuant to CVM 160, as amended. The issuance was