Franco Leutewiler Henriques (FLH) assisted Novakem Indústria Química, a leading Brazilian company specialized in high-performance chemical additives for concrete and cement, on the sale of a significant equity stake to Oriental Yuhong, a

VPBG, through its strategic alliance with Dentons, advised Circana on its acquisition of Nielsen’s Marketing Mix Modeling (MMM) business. This acquisition is a strategic move for Circana, as it expands its global presence and

Pinheiro Neto acted as deal counsel on the first issuance of simple debentures, non-convertible into shares, in a single series, for public distribution, by Companhia de Gás do Estado do Rio Grande do Sul –

BMA advised Grupo Aeroportuario del Sureste (ASUR), one of the leading airport operators in the Americas, on the negotiations and contracts for the acquisition of 100% of the shares issued by Companhia de Participações em

Benetti & Giammarino Advogados advised Bonduelle do Brasil Produtos Alimentícios, Brazilian subsidiary of the French multinational Bonduelle Group, on the selling of all its industrial assets located in the City of Cristalina, State of

Nomad, the fintech known for offering comprehensive solutions for Brazilians’ global financial needs established a partnership with Cepeda Advogados to expand access to expert knowledge on key legal topics relevant to Wealth clients—such as

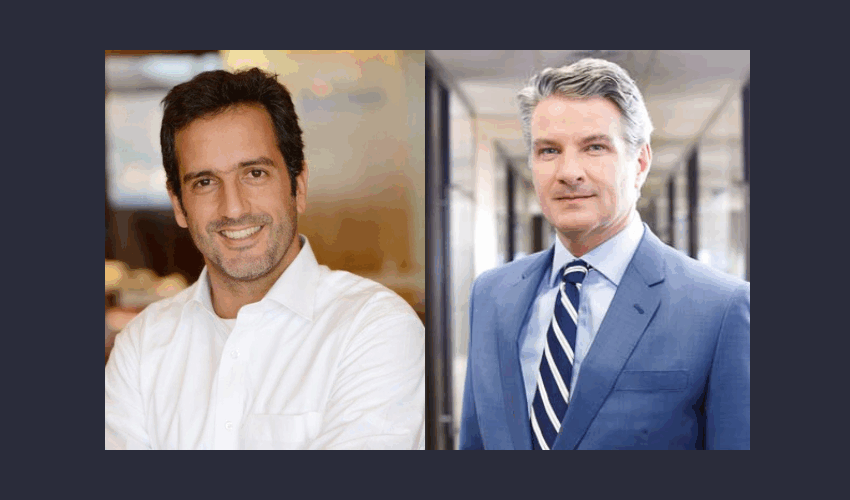

Pinheiro Neto Advogados announced the election of two new partners: Gianvito Ardito (picturted left) and Raíssa Lilavati Barbosa Abbas Campelo (pictured right).They will take office on January 1, 2026. With these appointments, the firm’s

Serur has announced the appointment of partner Tenylle Queiroga (pictured) to its board of directors, which also includes the partners Eduardo Serur, Aristóteles Camara, Ian Mac Dowell, and João Loyo. Tenylle’s is

CGM Advogados advised on the structuring and execution of Engibras Engenharia‘s first issuance of book-entry commercial notes, totaling BRL 10 million. Banco Luso Brasileiro acted as guarantor and holder of the commercial notes, while ID

Trench Rossi Watanabe advised Planner Corretora de Valores, an independent financial institution with diversified operations in Brazil, on the acquisition of Ciabrasf – Companhia Brasileira de Serviços Financeiros, a publicly traded company listed on B3.