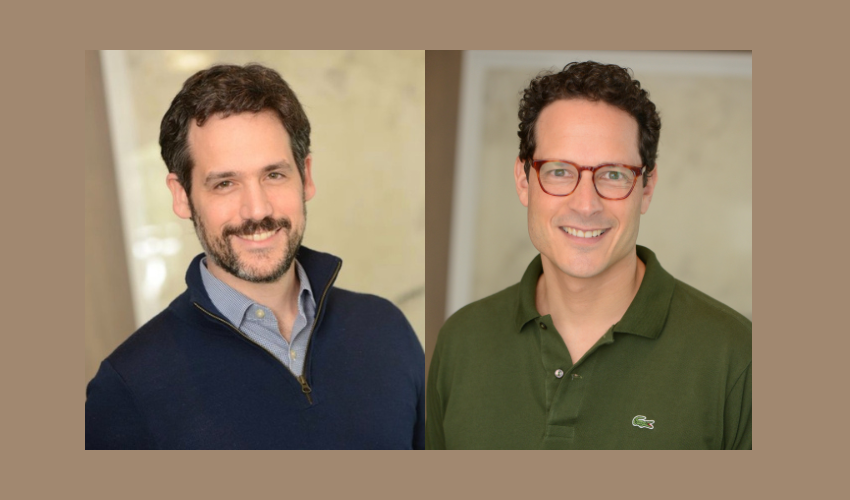

Bronstein, Zilberberg, Chueiri e Potenza Advogados advised Brazilian foodtech Olga Ri is merging forces with local restaurant chain Hi Pokee. Bronstein Zilberberg relied on partners Eduardo Zilberberg (pictured left); Sergio Bronstein (pictured right); associates Karina

TozziniFreire Advogados advised the flexible packaging manufacturer Graffo Paranaense, from Pinhais (PR), a company of Sonoco Group, on the acquisition of 100% of the package converter Inapel Embalagens, from Guarulhos (SP). This represents a strategic acquisition

Lefosse advised Iochpe-Maxion on its 12th issuance and public offering of non-convertible unsecured debentures, intended exclusively for professional investors, according to CVM 160, in the total amount of R$700 million. Pinheiro Guimarães advised Banco Itaú

Pinheiro Guimarães and Clifford Chance advised Klabin; Tauil & Chequer and Mayer Brown advised J.P Morgan in its role as lead coordinator on a US$ 595 million syndicated loan for Klabin, a Brazilian pulp

Mattos Filho has announced Paula Vieira (pictured) as the new partner in charge of the firm’s New York office. With a strong background in both Brazilian and cross-border M&A transactions, including private

Cescon Barrieu advised Banco BTG Pactual Serviços Financeiros Distribuidora de Títulos e Valores Mobiliários, as lead underwritter, on the public offering of units of the first issuance of the Real Estate Investment

Cescon Barrieu advised GDM Genética do Brasil on the acquisition of Sociedades Brasil, of Biotrigo Genética and Biotrigo Nutrição Animal, for an undisclosed amount. The closing of the transaction is subject to

Pinheiro Neto Advogados was the Brazilian counsel to the issuer and the guarantors in the transaction as part of a restructuring of the guarantors’ obligations to aircraft lessors and original equipment manufacturers, Azul Investments LLP,

Lobo de Rizzo Advogados advised Lagoa do Barro IX Energias Renováveis, Lagoa do Barro X Energias Renováveis, CGN Brasil Energia e Participações and Complexo Lagoa do Barro Energias Renováveis on the

Monteiro, Rusu, Camarão e Bercht Advogados has announced the promotion of Nathalia Satzke Barreto (pictured) as a new partner. She is a highly qualified professional with a 12-year career focused on civil litigation and