Pérez Alati, Grondona, Benites & Arntsen advised Genneia, Argentina’s leading renewable energy developer and generator, on a loan facility from Industrial and Commercial Bank of China (Argentina) in the aggregate amount of CNY 358,766,000 (

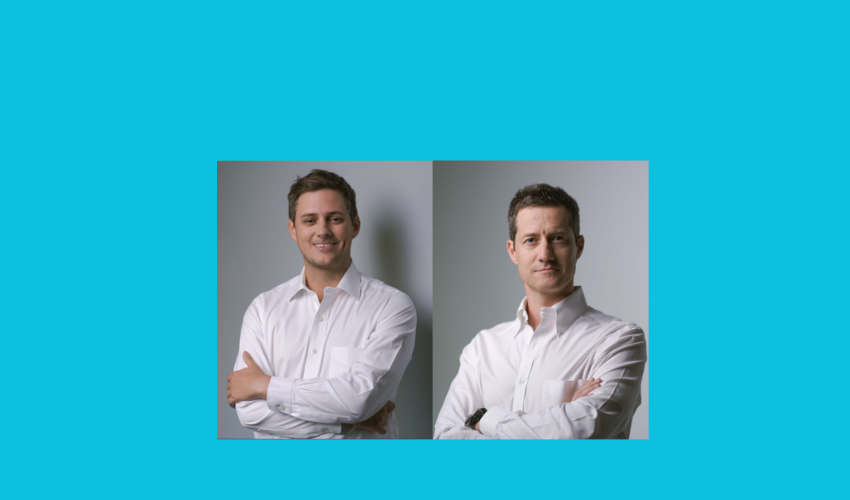

Marval O’Farrell Mairal has announced the appointment of two new partners: Alejo Martín Gascón (pictured left) and Milagros Ibarzábal (pictured right), which reflects the firm’s litigation & arbitration and public &

Cleary Gottlieb advised Petróleos Mexicanos (Pemex) on negotiating and executing a series of bilateral repurchase agreements with three international banks, along with a related securities lending transaction involving a special-purpose vehicle (SPV). The

Hernández & Cía has counseled Universidad Continental in the real estate assets acquisition in Ayacucho, in south-central Peru, as part of the university’s expansion strategy. The transaction involved the purchase of properties

Clifford Chance has advised BofA Securities and UBS Securities as initial purchasers in connection with Empresa Distribuidora de Electricidad de Mendoza (EDEMSA)’s US$150 million offering and issuance of its 9.75% Step-Up Notes due 2031. EDEMSA

Bruchou & Funes de Rioja and Salaverri Burgio Wetzler Malbrán served as legal advisors in connection with a US$150 million syndicated loan granted to Vista Energy Argentina. Banco de Galicia y Buenos Aires acted

ACR Legal advised Apus Química on the sale of a majority stake to IMCD. The transaction represents a major step for Apus Química’s entrepreneurial team, whose steady growth strategy attracted the interest

Philippi Prietocarrizosa Ferrero DU & Uría (PPU) acted as counsel to Arthur J. Gallagher in its acquisition of an insurance portfolio from Nusser Corredores de Seguros in Peru. The transaction was signed and closed

Clifford Chance has counseled BofA Securities, as initial purchaser, on the offering and issuance by the Comisión Ejecutiva Hidroeléctrica del Río Lempa (CEL) of US$580 million in aggregate principal amount of 8.650% Notes

Amid a wave of regulatory change, Mijares, Angoitia, Cortés y Fuentes has announced the appointment of Daniela Ortega Sosa (pictured center)and Paulina Fabara Laphan (pictured left) as counsels and heads of the Regulatory