Madrona Advogados advised Multiplike Securitizadora on the issuance of simple debentures, non-convertible into shares, with personal guarantee, in 3 series, of its 1st issuance, in the total amount of BRL 520 million, intended for professional investors. The debentures of the 1st and 2nd series were subject to a public offering, following the automatic registration procedure […]

Cescon Barrieu advised the issuer Localiza Rent a Car, the guarantor Localiza Fleet, and the underwriters UBS BB Corretora de Câmbio, Títulos e Valores Mobiliários, Banco Bradesco BBI, Itaú BBA Assessoria Financeira,

Marval O’Farrell Mairal has represented Loma Negra Compañía Industrial Argentina on its Class 5 Notes for a nominal value of US$112,878,134, at a fixed nominal annual interest rate of 8%, maturing on July 24, 2027. The

Stocche Forbes and Mattos Filho advised on the 1th issuance of debentures issued by OPEA SPE 02 Companhia Securitizadora de Créditos Financeiros – Agibank, pursuant to CVM 160, in the total amount of BRL 4 billion. The debentures

Clifford Chance has represented BofA Securities, as initial purchaser, on the US$580 million offering by Comisión Ejecutiva Hidroeléctrica del Río Lempa (CEL)of 8.650% Notes due 2033. This marks CEL’s inaugural international notes

Peruvian Miranda & Amado has acted as legal counsel to Compass Oportunidad Renta Fija Investment Fund in connection with two transactions involving privately issued bonds by Servicios Generales Saturno. The acquisition of bonds totaling PEN 12.6

Machado Meyer, TozziniFreire and others advised on the issuance of €350.0 million in aggregate principal amount increase (TAP) on the existing bond of Almaviva’s senior secured notes due 2030. The original bond was issued at the

Argentinean Marval O’Farrell Mairal has advised Adecoagro on the issuance of international notes due July 29, 2032, under New York law and guaranteed by select company subsidiaries, as part of a Rule 144A/Reg S offering

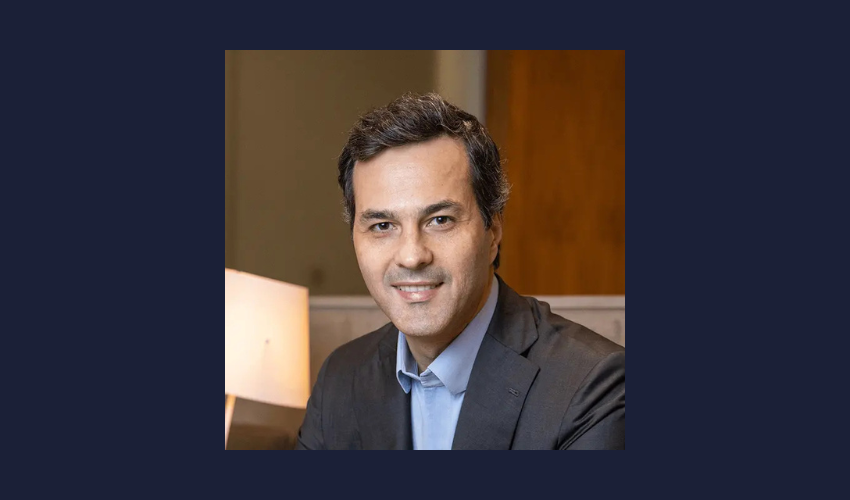

Leite, Tosto e Barros Advogados has announced the arrival of Francisco Timoni (pictured) as a new partner in its capital markets practice, in a strategic move to expand its work in complex financial transactions. With 15

Machado Meyer acted as deal counsel on the 3rd issuance of debentures, non conversible, in two series, unsecured, for public distribution through the automatic registration rite, pursuant to CVM Resolution 160, of Hospital Mater Dei, in