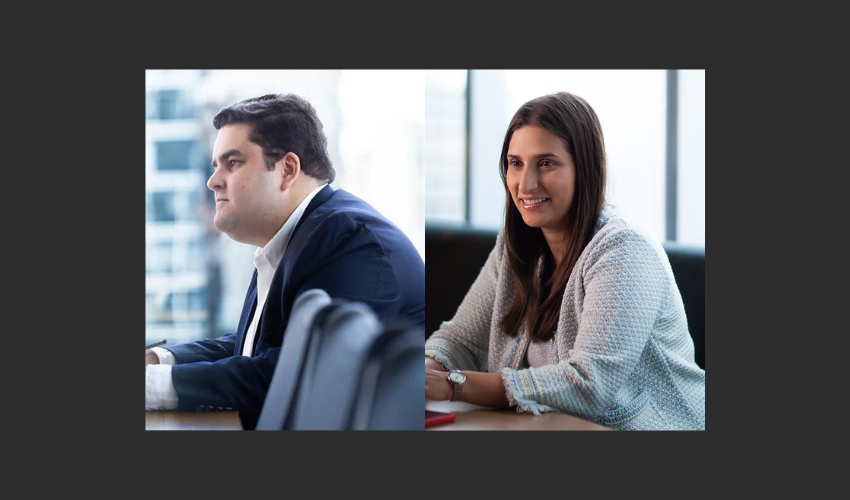

Demarest advised DN Solutions on assessing the risks and legal liabilities related to the acquisition of Heller, contributing to the structuring of the transaction in partnership with the Korean law firm Kim&Chang. Demarest relied on partners Daniel O. Andreoli (pictured left) and Min Gon Kim (pictured right), and associate Melissa Lee Thia Chen.

Stocche Forbes advised SEK Security Ecosystem Knowledge, on the acquisition of control of NetBR Distribuição e Consultoria em Informática, a company operating in the cybersecurity sector and a leading provider of Identity &

Graça Couto Advogados advised GMM Pfaudler, through its Brazilian subsidiary Pfaudler, on the acquisition of 100% of the share capital of SEMCO Tecnologia em Processos. This strategic transaction reinforces GMM Pfaudler’s global Mixing Technologies

TozziniFreire Advogados advised International Finance Corporation – IFC, as the lender, on the financing Cogna Educação (COGNA), as the borrower, for the raising of funds amounting to USD 100 million. The resources will be allocated to

Mattos Filho represented Adufértil Fertilizantes, a company within the Indorama Corporation group (fertilizer segment), on the acquisition of the entire share capital of Fass Indústria e Comércio de Produtos Agropecuários, a

Dias Carneiro advises Proparco on cross-border financing for Frooty

Dias Carneiro Advogados advised Société de Promotion et de Participation Pour la Coopération Économique (Proparco) on the granting of financing in the amount of up to USD 10 million to Frooty Comércio e

Machado Meyer advised on the acquisition of shares and subscription of new shares by Sankhya Jiva Investimentos e Participações, representing a majority stake in the share capital of Lincros Soluções em Software. Machado

Pérez-Llorca Mexico has counseled Bunzl, a British multinational distribution and services company, in acquiring full ownership of Guantes Internacionales, a prominent Mexican producer of industrial gloves and sleeves. This acquisition also included select US

Pinheiro Neto advised Qualicorp Consultoria e Corretora de Seguros on the sale of 100% of the capital stock of its subsidiary Gama Saúde to ESB Corp holding. The closing of the transaction is subject to

Levy Salomão and TozziniFreire advised on the transaction in which Novelis Corporation priced a senior note offering with an aggregate principal amount of US$750 million and an interest rate of 6.375%, maturing in August 2033. The