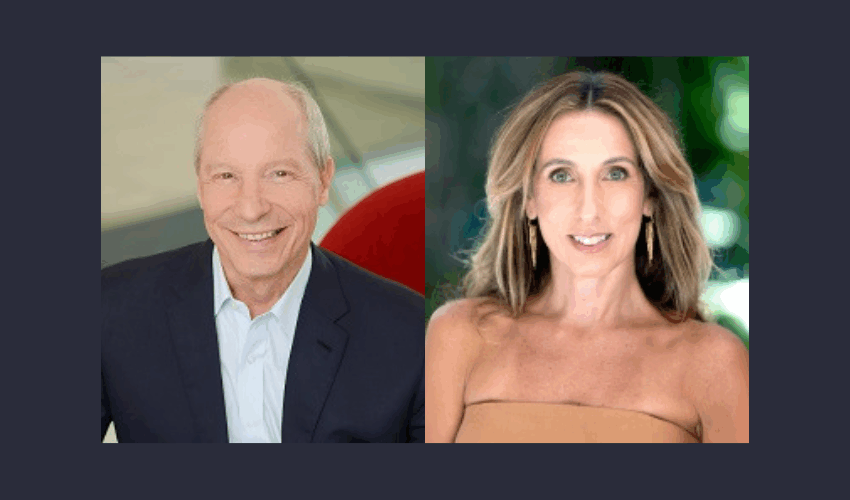

Cescon Barrieu advised Parsons Corporation on the sale of an indirect equity interest in a joint venture, involving the transfer by its subsidiary TRS International of 50% of the capital stock of TRS-Doxor to its partner Doxor, which was advised by Lobo de Rizzo. Cescon Barrieu relied on partner Leandro Tavares Corrêa Pinto (pictured left) […]

PMK advised HBR Realty on the sale of the entirety of the equity quotas representing the share capital of HBR 33 – Investimentos Imobiliários, owner of the Hotel Hilton – Rebouças, to CVPAR Fundo de Investimento

Demarest advised Mr. Carlos Aurélio Dompieri Filho, holding 50% of the capital stock of Vibropac Indústria e Comércio de Equipamentos, on the acquisition of the remaining 50% equity interest in the company. The transaction

Trench Rossi Watanabe advised Inter-American Investment Corporation (IDB Invest), the private sector arm of the IDB Group, and Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO), a Dutch business development bank, on an investment made through

Philippi Prietocarrizosa Ferrero DU & Uría (PPU) has served as legal counsel to Grupo Romero on the acquisition of 49% stake in GTData HoldCo, the holding company that oversees GTD’s data center operations in

Pinheiro Neto Advogados advised Ultrapar Participações on the acquisition of a 37.5% stake in Virtu GNL Participações. The amount paid by Ultrapar will be BRL 102.5 million, of which BRL 85 million will be used to

Azevedo Sette Advogados advised Simon Brasil Participações, a wholly owned subsidiary of Simon Holding, a holding of Grupo Simon, a Spain-based conglomerate that operates in the business of lighting and electrical materials, on the

Madrona Advogados represented EDP Trading Comercialização e Serviços de Energia, a subsidiary of EDP – Energias do Brasil, on the sale of its entire interest in EDP Transmissão Litoral Sul, the owner of

Lefosse advised Fundo de Investimento Imobiliário – FII Ancar IC on the acquisition of 10% of Shopping Jardim Sul, owned by Hedge Brasil Shopping Fundo de Investimento Imobiliário. The transaction was concluded with the payment

BMA Advogados, under the global coordination across all jurisdictions involved of Skadden, Arps, Slate, Meagher & Flom, advised GE Vernova on the acquisition of the stake held by the Mexican group Xignux in Prolec GE,