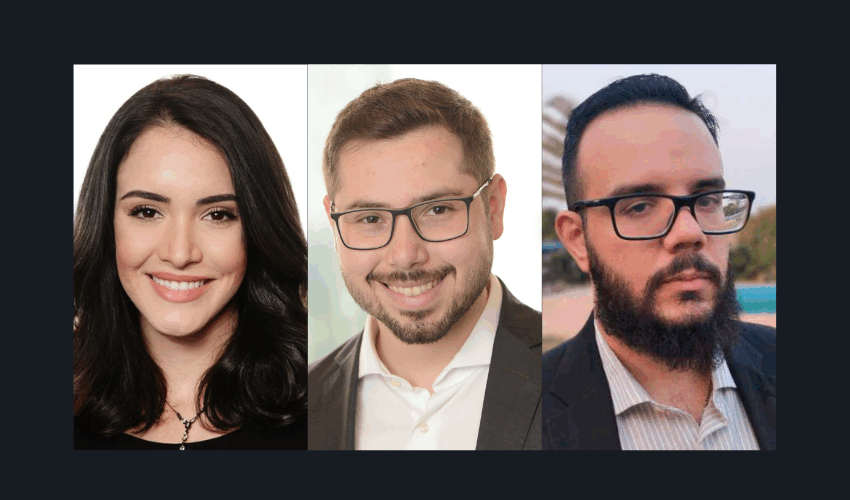

Galatti Advogados is a new law firm focused on tax and corporate law. Founded by Camila Galatti, Raphael Marins, and Lucas Galante (pictured from left to right), professionals with over a decade of experience at

Pinheiro Neto Advogados advised as deal counsel of the transaction, comprising the acquisition, by Álvaro Augusto de Freitas Vidigal of 97.48% of the shares of Banco Paulista, previously held by his father, Álvaro Augusto Vidigal. The

TozziniFreire Advogados advised Petrobras on the acquisition of a 49,99% equity stake in a cluster that includes a commercially operating photovoltaic plant and a pipeline of 14 greenfield solar projects. The investment marks a key step in

Pérez-Llorca has advised Promigas on the acquisition of 100% of the shares of the companies that own and operate Zelestra’s renewable generation platform in Latin America, with assets in Colombia, Chile, and Peru. The

The monthly report by TTR Data (ttrdata.com) revealed that in November, 110 mergers and acquisitions were recorded, between announced and completed, with a total value of BRL 26.3 billion. The transaction highlighted by TTR Data in

Madrona Advogados acted as deal counsel on the 2nd issuance and public offering of debentures by TMXV Eficiência Holding, in the total amount of BRL52,500,000.00. The issuance is guaranteed by fiduciary assignment of credit

Martínez Quintero Mendoza González Laguado & De La Rosa has advised Healthcare MX Holdings, a company managed by Patria Investments, on the acquisition of UnitedHealth Group’s business operations in Colombia and Chile.

KLA announced that, as of January 2026, lawyer Ana Carolina Cesar (pictured) will join the firm’s partnership. At KLA since 2019, she heads the Data Protection, Intellectual Property, and KLAI (KLA’s Artificial Intelligence hub) departments.

Franco Leutewiler Henriques Advogados (FLH) has announced Allan Borba Bercht (pictured) as a new partner in the banking, finance, and capital markets practice, with a special focus on debt capital markets (DCM) and structured finance.

Cescon Barrieu and Machado Meyer advised on the second issuance of simple, non-convertible debentures by Concessionária da Rodovia MS 306. The secured, single-series notes were offered through a public distribution under CVM 160. The offering was