GSV Group and JL Contabilidade have announced a merger that creates one of the country’s leading firms in integrated accounting, technology, and strategic consulting. The operation comes at a decisive moment: the transition to

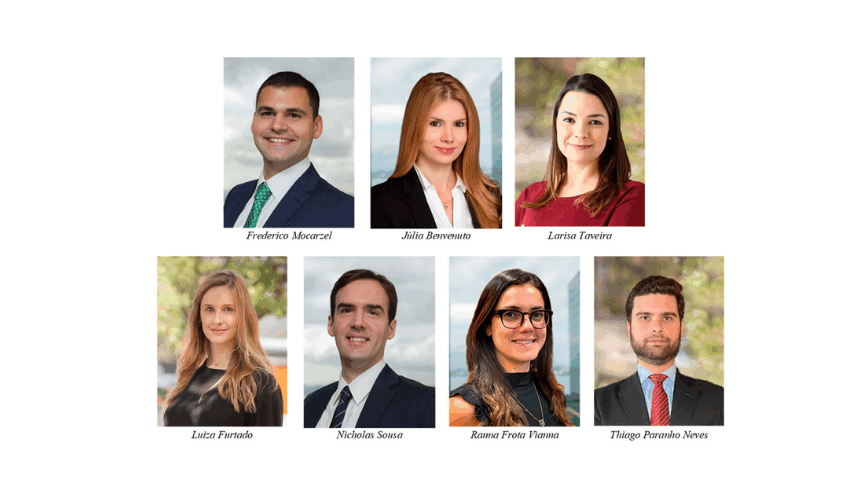

Pinheiro Guimarães announced the promotion of seven lawyers to its partnership, enhancing the firm’s capabilities in the Capital Markets, Corporate and M&A, Litigation & Arbitration, Restructuring & Insolvency and Tax areas

MQMGL&D guides Sacyr through USD $1.56B infrastructure sale in Colombia Martínez Quintero Mendoza Gonzáles Laguado & De La Rosa has advised Grupo Sacyr on its corporate reorganization and the subsequent USD $1.565

Mattos Filho provided a comprehensive review of the bidding process, tender rules, and regulatory framework for Brazil’s production-sharing regime through a due diligence report. We also provided support on several practical matters related to

TozziniFreire acted as a Brazilian counsel to Eldorado Brasil Celulose on the issuance and sale of 8.500% senior notes due 2032 in the aggregate principal amount of USD 500 million, by the Eldorado Intl. Finance GmbH, guaranteed by

Leonardo Lamachia, partner at Lamachia Advogados Associados was sworn in as the first president of the Forum of Councils and Orders of Regulated Professions of Rio Grande do Sul (Fórum-RS). The Forum-RS, which brings

Pinheiro Guimarães advised the founders of BYX Capital on the acquisition of the 33% stake held by Banco Pine in the company. The purchase price involves a mix of cash payment of R$100 million and

Pinheiro Neto advises Celm, Santos Neto Advogados advised Itaú BBA and Bradesco BBI, on the public offering of Agribusiness Receivables Certificates (CRA) of 158th issue of Opea Securitizadora, backed by Agribusiness Credit Rights due by

Demarest is advising Associacao Escola Superior de Propaganda E Marketing – ESPM on the execution of a binding agreement related to the acquisition of the educational operations of Escola Panamericana de Arte, which will be renamed

Machado Meyer acted as deal counsel to Pitangueiras Açúcar e Álcool and Itaú BBA on structuring Pitangueiras’s first issuance of commercial notes, totaling BRL 150 million. The notes were privately placed and fully subscribed