VBSO Advogados acted as legal counsel to Riza Asset Management on the structuring of the FIAGRO Terrax Vintage. The Fund raised BRL 408,627,100.00 from individual investors, legal entities, investment funds, and financial institutions that participated in

Azevedo Sette Advogados advised Simon Brasil Participações, a wholly owned subsidiary of Simon Holding, a holding of Grupo Simon, a Spain-based conglomerate that operates in the business of lighting and electrical materials, on the

Stocche Forbes acted as legal counsel to the joint global coordinators of the senior notes (Bonds) issued by PRIO Luxembourg Holding, which was advised by Cescon Barrieu. The issuance was valued at US$ 700 million. The

Madrona Advogados represented EDP Trading Comercialização e Serviços de Energia, a subsidiary of EDP – Energias do Brasil, on the sale of its entire interest in EDP Transmissão Litoral Sul, the owner of

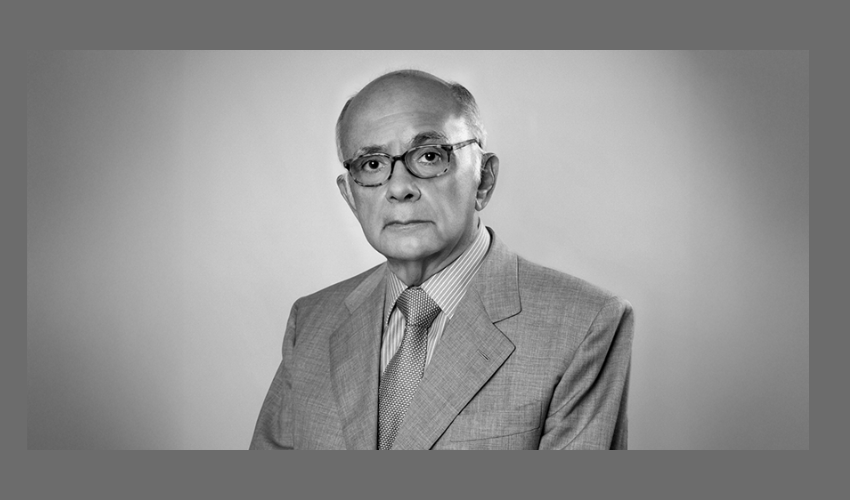

Lawyer Sergio Bermudes died on Monday (27) at age 79, after a long period of hospitalization. Bermudes dedicated almost half a century to law and established himself as one of the most respected proceduralists in the Brazil.

Cleary Gottlieb has advised YPF, as borrower, in a $700 million secured term loan facility, enhancing the company’s financial flexibility. BBVA, Bladex, Santander, and Itaú Unibanco acted as joint lead arrangers and bookrunners, while Citibank

Stocche Forbes advised the issuer, Lefosse advised the underwriter on the third issuance of simple, non-convertible debentures, of the unsecured type, to be convolved in the secured type, by Celeo Redes Transmissão de Energia,

Lefosse advised Fundo de Investimento Imobiliário – FII Ancar IC on the acquisition of 10% of Shopping Jardim Sul, owned by Hedge Brasil Shopping Fundo de Investimento Imobiliário. The transaction was concluded with the payment

BMA Advogados, under the global coordination across all jurisdictions involved of Skadden, Arps, Slate, Meagher & Flom, advised GE Vernova on the acquisition of the stake held by the Mexican group Xignux in Prolec GE,

Landi Rodrigues advised the issuer and Cescon Barrieu advised Galapagos Capital, as the sole the underwriter, on the 1st issuance of non-convertible debentures, for public offering, by Reserva Paulista, pursuant to CVM 160. The proceeds from