Special Report 2017 Latin America – Central America: Reasons for cheer

More global law firms are expected to set up shop in Central America with some of the best growth opportunities for law firms and investors alike to be found in Costa Rica, which is forging a reputation as one of the best countries in the region in which to base businesses – indeed, the outlook for the entire region looks bright, with a significant number of law firms anticipating healthy increases in revenue in the coming year

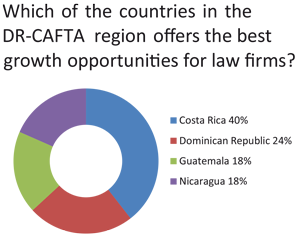

As foreign investment in the country increases year-on-year, and given that the nation has a stronger economy than that of its neighbours, Costa Rica is currently offering very promising growth opportunities for law firms. A new survey of lawyers in Central America conducted by The Latin American Lawyer found that Costa Rica is currently the star performer among the Central American countries covered by the Dominican Republic-Central America free trade agreement (DR-CAFTA) – those countries being Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, as well as the Dominican Republic.

Given its current pre-eminence in the region, foreign investors are choosing Costa Rica as a base from which to expand their operations to neighbouring countries. “Costa Rica continues to be a jurisdiction in which investors start their business to then grow throughout Central America,” says Diego Martin, an El Salvador- based partner at regional law firm Consortium Legal. This echoed the sentiment of many of the lawyers who participated in the survey, with a total of 40 per cent identifying Costa Rica as the DR-CAFTA country that offers the best growth opportunities.

Legal market growth

Legal market growth

According to a June 2017 report by the International Monetary Fund, Costa Rica’s economy is currently growing at a rate of 4.25 per cent. This was borne out by The Latin American Lawyer survey, in which respondents from Costa Rica highlighted rises in M&A and real estate transactions as major generators of instructions for law firms. Mariano Batalla, partner at Batalla in Costa Rica, predicts a growth in legal services in the country – as well as the wider region – with most of the increase driven by the creations of new service lines and the more efficient use of resources across practice areas such as banking and finance, corporate and M&A and dispute resolution. Mauricio Salas, partner at BLP in Costa Rica, added that compliance, growing awareness of the Foreign Corrupt Practices Act (FCPA), the increasing sustainability of companies, in addition to employment-related arbitration were emerging trends that would be drivers of growth at law firms.

In this context, a key challenge for law firms is keeping up-to-date with market developments and the changing legal requirements of clients, according to Susana Vásquez, corporate affairs and legal director at Stein Corp in Costa Rica. She added that it was also vital that firms ensure that the quality of legal services is standardised throughout the region.

Incentivising investment

Elsewhere in the region, the Dominican Republic’s economy has also been performing reasonably well in recent years, says Joanna Bonnelly, senior associate at Pellerano & Herrera, in Santo Domingo. The country has introduced a number of measures including tax incentives for renewable energy and filmmaking, among others, in an attempt to attract more investment, particularly from private equity firms, Bonnelly adds.

Meanwhile, Mary Fernández, founding partner at Dominican Republic law firm Headrick Rizik Álvarez & Fernández, highlights restructuring, insolvency, regulatory changes, competition and consumer protection law, as well as environmental law as significant sources of work. Other participants noted that “a bigger regulatory burden in the Dominican Republic is increasing the need for regulatory [legal] counsel.”

One of the key challenges for law firms in the Dominican Republic, according to study respondents, is the growing competition for talent, which is a trend that is increasing costs for firms. In addition, there is significant pressure on rates due to more aggressive drives on the part of law firms to capture clients. Fernández adds that, in order to adapt to the new environment, law firms face the pressures of having to keep the ‘millennial’ generation of lawyers motivated as well as providing cost-effective services to clients.

Corruption scandals

Guatemala and Nicaragua are fairly similar in terms of the opportunities they offer for law firms, according to study participants. Both markets present challenges for investors, for example there are some concerns that the flow of direct investment towards Guatemala could be affected in the wake of the ongoing corruption scandals in that country. However, this environment is generating work for law firms, with many clients seeking help from lawyers in conducting risk assessments, says Jorge Luis Arenales, a partner at Arias in Guatemala, who highlights tax and employment as significant sources of work for law firms operating in the country.

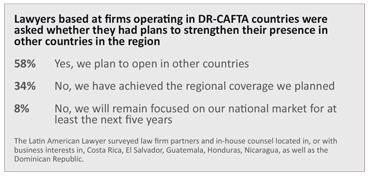

Vanessa Oquelí, Honduras managing partner at García & Bodán, argues that Central America as whole is becoming an increasingly attractive market for investors. Consequently, law firms are, in general, on a drive to strengthen their presence across the DR-CAFTA region. Indeed, only 13 per cent of survey respondents worked for law firms with operations in only one country, and it was an even smaller proportion (7 per cent) that said they would be focusing solely on their domestic market over the next five years. The vast majority of respondents (58 per cent) said they had plans to open in other DR-CAFTA countries.

Reluctant to grow

Responses from the Dominican Republic showed that law firms there are less inclined to open offices in other DR-CAFTA countries than their counterparts in the other five countries. Of the firms from the Dominican Republic, only DMK Lawyers has sought some level of regional integration, having joined Central Law, which has offices across Central America. One managing partner of a law firm in Santo Domingo says that “after five years we expect to have the ability to explore the integration possibility but it is not our main goal”. Another lawyer based in the country says that “while there is no concrete plan, regional integration is the natural path to go because of the growth in cross-border transactions where local lawyers take part”. Headrick Rizik Álvarez & Fernández, meanwhile, is serving other countries in the region via a legal network, or via relationship law firms, and has no formal plans to expand, according to Mary Fernández, who adds: “We are open to revisiting those plans in two to three years.” Other firms in the Dominican Republic have adopted similar strategies in an effort to capture international mandates: Pellerano & Herrera is the Dominican member of Lex Mundi, the global network of independent law firms, while intellectual property boutique Bufete Messina & Lugo IP offers trademark registration in all the Caribbean countries through its membership of the Intellectual Property Caribbean Association (IPCA).

Other firms in the Dominican Republic have adopted similar strategies in an effort to capture international mandates: Pellerano & Herrera is the Dominican member of Lex Mundi, the global network of independent law firms, while intellectual property boutique Bufete Messina & Lugo IP offers trademark registration in all the Caribbean countries through its membership of the Intellectual Property Caribbean Association (IPCA).

Cutting costs

In Costa Rica, where several pan-regional law firms have originated, Facio & Cañas is planning to expand to other countries in Central America within five years, according to managing partner Sergio Solera. Previously, the firm, which is a member of Lex Mundi, had shunned regional expansion, but Solera says the need to modernise and expand as well as search for more efficiency and cost reductions is a key challenge for law firms. Batalla says his firm has plans to strengthen its presence in the DR-CAFTA region within the next five years, adding that addressing this issue is one of the key challenges facing Costa Rican law firms.

Meanwhile, a number of pan-regional law firms have originated in Nicaragua: namely García & Bodán which later expanded to El Salvador, Honduras and Guatemala; and Consortium Legal, which included Nicaragua-based Taboada & Asociados among its founding members. Gerardo Hernández, a partner based in the Managua office of Consortium Legal, says that Nicaragua has become more attractive to investors due to the harmonisation of local laws with those elsewhere and the fostering of a more investor-friendly environment. This has had the effect of attracting regional and global law firms, he adds.

Increasing competition

The desire of law firms to strengthen their presence across the DR-CAFTA region is evidenced by the fact that Consortium Legal is fielding enquiries from law firms with a view to potentially joining forces. Law firms in other jurisdictions have “shown interest in becoming members of our firm so this is something that we are certainly evaluating – we are not closed to expanding our practice to other countries,” says one firm insider.

Meanwhile, García & Bodán – which currently has offices in Guatemala, El Salvador, Honduras and Nicaragua – is planning to step up the competition with its rivals by opening in Costa Rica, says Terencio García, regional managing partner. García is confident about the outlook for the region and expects the firm will eventually cover all of Central America in order to take advantage of opportunities in sectors such as banking and finance, infrastructure, public-private partnerships, dispute resolution and real estate.  For many law firms, expanding their presence in the DR-CAFTA region poses a number of problems, according to Álvaro Castellanos, partner at Consortium Legal in Guatemala. “Ten years ago there were few pan-regional (Central American) law firms; Consortium was the second to be formed,” he says. “Now, there are more than ten, and it seems that regionalisation has become the standard for services for any law firm competing for clients bringing foreign investment.” In addition, Castellanos also forecasts the arrival of new players in the market: “Before 2015, Central America did not look like a market for global law firms and now we have Dentons here.”

For many law firms, expanding their presence in the DR-CAFTA region poses a number of problems, according to Álvaro Castellanos, partner at Consortium Legal in Guatemala. “Ten years ago there were few pan-regional (Central American) law firms; Consortium was the second to be formed,” he says. “Now, there are more than ten, and it seems that regionalisation has become the standard for services for any law firm competing for clients bringing foreign investment.” In addition, Castellanos also forecasts the arrival of new players in the market: “Before 2015, Central America did not look like a market for global law firms and now we have Dentons here.”

The arrival of Dentons in Costa Rica, Guatemala and Panama in 2016 sent shockwaves through the Central American legal market, not least because it caused the split of the firm Arias & Muñoz, which many considered the pioneer of pan-regional law firms in the area given its longstanding presence in Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and more recently, Panama.

Dentons was not the first international law firm in the region – Santo Domingo became home to one in 1998 when Steel Hector & Davies (now Squire Patton Boggs) launched an office in the Dominican Republic. However, Squire Patton Boggs has yet to show interest in expanding in the region. More recently, global immigration boutique Fragomen, EY and employment outfit Littler Mendelson have all established operations in the DR-CAFTA region.

Global players arriving?

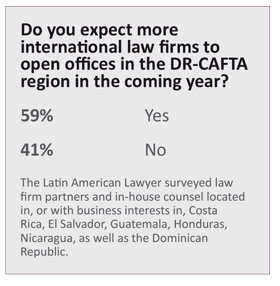

The majority of lawyers (60 per cent) who responded to the survey said they expected new international or global law firms to arrive in the DR-CAFTA region. One managing partner of an independent firm says firms in Central America, like those in other areas of Latin America, are vulnerable to competition in the shape of global firms establishing operations in the region. Álvaro Castellanos, Guatemala partner at Consortium Legal, says global players that do so will merely be mirroring the expansion of their clients. Meanwhile, Ana Messina, partner at Bufete Messina & Lugo IP in the Dominican Republic, expects more Spanish law firms to expand to the region, as they have done elsewhere in Latin America.

Nevertheless, other survey participants are not convinced there will be an influx of global law firms into the DR-CAFTA region. Oscar Samour, El Salvador partner at Consortium Legal, believes international law firms are not especially keen on opening in Central America. This sentiment is echoed by Alejandro Cofiño, partner at QIL+4 in Guatemala: “The market in Central America is not that interesting or robust for an international firm.”

Positive outlook

Positive outlook

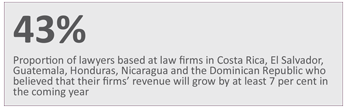

The overall outlook for law firms in Central America and the Dominican Republic is positive, with 97 per cent of lawyers surveyed expecting growth, largely driven by regulatory changes, a more positive economic outlook across the region and new service lines. Meanwhile, nearly 30 per cent of interviewees expect revenue to increase by 5-6 per cent, in large part due to an expected increase in corporate/M&A and dispute resolution mandates.

Just over half (51 per cent) of lawyers expect the US market to contribute the most growth for law firms in the coming year. Meanwhile, almost one third (31 per cent) predict that Latin American companies will continue growing in the DR-CAFTA countries, with the result that there will be more instructions for local and regional law firms. Ruby Asturias, Guatemala managing partner at Pacheco Coto, says that businesses in other Latin American countries are looking at the Central American region as a potential target for investment. “Although the US remains our most important investor, we have seen the growth of interest from the rest of Latin America,” she adds. Meanwhile, Vanessa Oqueli, partner at García & Bodán, expects multilatinas (global companies originated in Latin America) to further expand their businesses throughout the Central American region.

Finally, a number of lawyers anticipate that the policies of US President Donald Trump will have a positive effect on the region’s economy. They argue that traditional US-bound investment from countries such as Mexico could potentially fall victim to trade barriers; consequently money flows are likely to pivot towards Central and South America.