VBSO Advogados and Monteiro Rusu Advogados, together with Itaú, Laqus, Liqi and Oliveira Trust, tokenized a commercial paper worth R$ 40 million from a company in the electric sector following the regulations of a traditional public

Tags :cn1

Pinheiro Neto Advogados acted as deal counsel on the 2th issue of simple unsecured debentures, non-convertible into shares, for public distribution, in a single series, under the automatic rite, issued by Raízen, in accordance

Pinheiro Neto advised the issuer and Machado Meyer advised the underwriterson the 5th issue of simple debentures, not convertible into shares, of the unsecured type, in up to 3 series, for public distribution, under the automatic

Pinheiro Neto advised BTG on the acquisition of 100% of Serglobal Participações, the parent company of Sertrading group, an important player in foreign trade focused on import transactions, which was advised by Mattos Filho. The

Pinheiro Neto Advogados advised the issuer, and Machado Meyer advised the lead underwriter on the 2nd issuance of simple debentures, not convertible into shares, in a single series, unsecured, with additional fiduciary guarantee, for public

Machado Meyer advised Evergreen on the due diligence of Guarde Aqui and on the negotiation of the share purchase agreement and other covenants. Stocche Forbes advised the sellers, Guarde Aqui. The transaction increases the company’

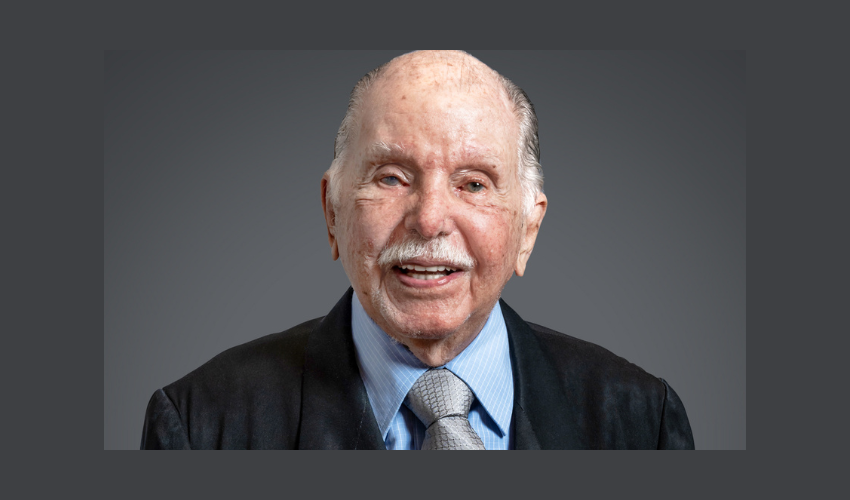

With heavy hearts, Villemor Amaral Advogados announced the death of Dr. Hermano de Villemor Amaral (son) (pictured), at the age of 104, in the early hours of Thursday morning (18/07), in the city of Rio de Janeiro.

Cascione Advogados advised the issuer; Tauil & Chequer Advogados associated with Mayer Brown advised the underwriters on the structuring and coordination of EDP São Paulo‘s 17th debenture issue, which was carried out through

Tauil & Chequer Advogados, in association with Mayer Brown, advised TG Core Asset, an investment manager, on the public offering of primary distribution of quotas of the 13th issue of the TG Ativo Real Estate

Santos Neto Advogados (SNA) advised Trinity Energias Renováveis, one of the largest energy traders in the country, in the formation of a joint venture with Evolua, through the acquisition of quotas representing the entire