TozziniFreire and Pinheiro Neto advised on different unsecured debenture offerings by CPFL group companies, publicly distributed and coordinated by Bradesco BBI. TozziniFreire acted as Brazilian counsel to the issuers on two issuances of simple, unsecured

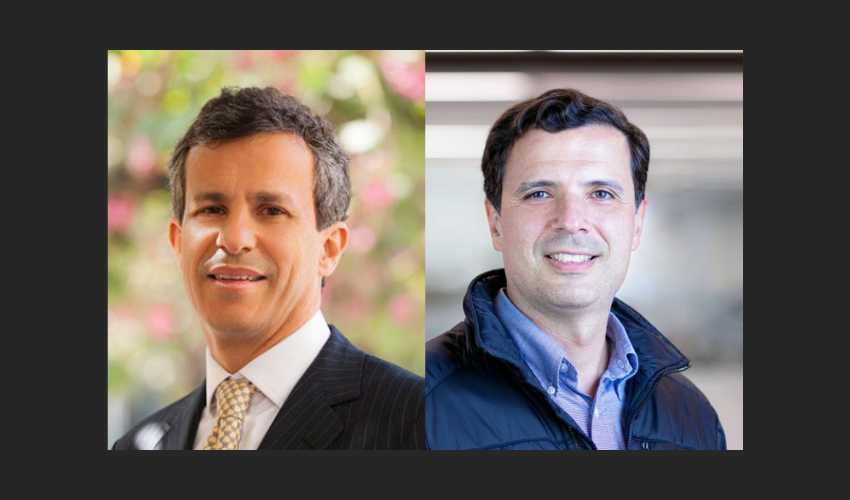

Tags :Daniel Laudisio

TozziniFreire acted as a Brazilian counsel to the issuer on issuance of simple unsecured debentures, with additional corporate guarantee by Angelina Colombo Participações and João Colombo Agroindústria, in a single series, for

Pinheiro Neto advised the issuer; TozziniFreire advised the initial purchase acting as Brazilian counsels on the issuance by Azul of 723,861,340,715 new common shares and 723,861,340,715 new preferred shares for an aggregate R$ 7,441,550,992.27, consisting of R$ 97,915,144.64 for

TozziniFreire acted as a Brazilian counsel to the issuer on issuance of simple unsecured debentures, with additional corporate guarantee by CPFL Energia, in a single series, for public distribution, by the issuer, in the total

TozziniFreire acted as a Brazilian counsel to Eldorado Brasil Celulose on its issuance of simple secured debentures, in a single series, for public distribution, in the total amount of BRL 1 billion, publicly offered by Banco

TozziniFreire acted as a Brazilian counsel to the issuer Athena Saúde on the 4th issuance of single unsecured debentures, in the total amount of BRL 1 billion, publicly offered through Itaú BBA Assessoria Financeira, Banco

TozziniFreire Advogados advised Companhia Paulista de Força e Luz (CPFL Paulista), Companhia Piratininga de Força e Luz (CPFL Piratininga) and RGE Sul Distribuidora de Energia (RGE Sul); Lobo de Rizzo advised Itaú BBA

Lefosse and TozziniFreire advised on the 494th issuance of the real state receivables certificates issued by Opea Securitizadora, in a unique series, in the total amount of BRL 500 million, publicly offered through the underwriters BTG

Pinheiro Guimarães Advogados advised Panati Holding and Marangatu Holding, as issuers, and the guarantors; TozziniFreire advised the underwriter Banco Bradesco BBI on the issuers’ first issuances of single debentures, unsecured, to be converted into

TozziniFreire continues with its strategy of consolidating and strengthening its Corporate team, now with the arrival of partner Daniel Laudisio (pictured) for the practices of Corporate and M&A, Capital Markets, and Banking and