KLA Advogados advised on Tellus Properties Real Estate Investment Fund on the acquisition of Top Center FII the office tower and a 70% stake in the parking facility of the Top Center complex on Avenida Paulista,

Tags :Madrona Advogados

Madrona advised V.TAL – Rede Neutra de Telecomunicações on the acquisition of 1TELECOM Serviços de Tecnologia em Internet. 1Telecom and its subsidiaries provide solutions in connectivity, mobility, information security, and cloud computing, with

Madrona Advogados acted as deal counsel on the 2nd issuance and public offering of debentures by TMXV Eficiência Holding, in the total amount of BRL52,500,000.00. The issuance is guaranteed by fiduciary assignment of credit

Madrona Advogados advised Delicatessen Produção de Filmes on an investment agreement with the founders of Coiote Produções Cinematográficas and MCA Produções Cinematográficas, for a capital increase corresponding to a 40% equity

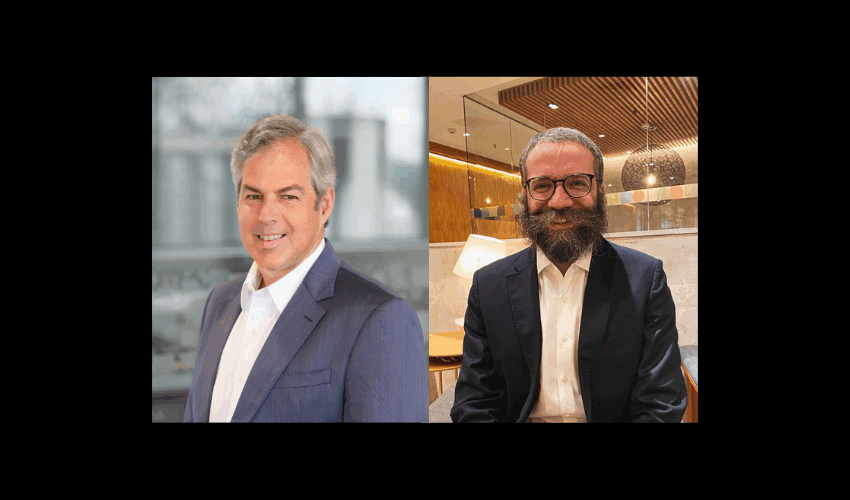

Madrona Advogados, has announced the appointment of Danilo Mininel (pictured) as its next Chief Executive Officer (CEO), effective January 2026, for a three-year term. The decision, formalized during a partners’ meeting, is part of a structured

Madrona Advogados represented EDP Trading Comercialização e Serviços de Energia, a subsidiary of EDP – Energias do Brasil, on the sale of its entire interest in EDP Transmissão Litoral Sul, the owner of

Madrona Advogados advised on the transaction in which Ecom Energia and EDF Power Solutions joined forces to operate in the retail electricity market, opening up a new front for both companies. EDF now competes in

Madrona Advogados advised Manaslu Brasil Partners I K FIP Multiestratégia IE Responsabilidade Limitada on the sale of 100% of the share capital of No Zebra Network (NZN) to “O Estado de S. Paulo” (Estadão).

Machado Meyer advised BRF on the structuring of a self-production energy agreement with Auren Energia, enabling BRF to acquire equity in five wind farms across Bahia and Rio Grande do Norte. The deal supports BRF’

Madrona Advogados advised Raízen on the structuring of the transaction, drafting and negotiation of the documents to implement the dissolution of the joint venture established in 2019 through the Rede Integrada de Lojas de Conveniê