BMA advised Grupo Aeroportuario del Sureste (ASUR), one of the leading airport operators in the Americas, on the negotiations and contracts for the acquisition of 100% of the shares issued by Companhia de Participações em

Tags :Pinheiro Neto

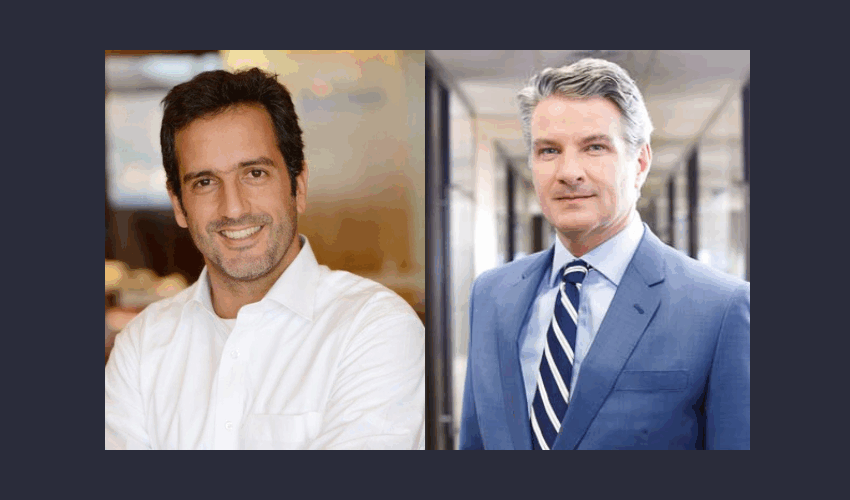

Pinheiro Neto Advogados announced the election of two new partners: Gianvito Ardito (picturted left) and Raíssa Lilavati Barbosa Abbas Campelo (pictured right).They will take office on January 1, 2026. With these appointments, the firm’s

Pinheiro Neto Advogados announces Vanessa Jacob Heck (pictured) as the firm’s new consultant. With over 20 years of experience advising emerging companies, investors, and venture capital funds throughout Latin America, Vanessa offers a strategic and

Pinheiro Neto Advogados acted as counsel to Cielo – Instituição de Pagamento and Machado Meyer Advogados acted as counsel to UBS Corretora de Câmbio, Títulos e Valores Mobiliários and Banco Bradesco BBI

Pinheiro Neto Advogados advised Ultrapar Participações on the acquisition of a 37.5% stake in Virtu GNL Participações. The amount paid by Ultrapar will be BRL 102.5 million, of which BRL 85 million will be used to

Pinheiro Neto Advogados acted as deal counsel to Oranje – Educação e Investimento in its reverse merger with Cursinho Intergraus, a long-standing education company with over four decades of experience in preparatory courses. The transaction

Souto Correa Advogados advises LF Comercial de Bens, part of the GG10 Group (which operates through brands such as LF Máquinas e Ferramentas, Duncan Pneus, G-Haus, Serello Consórcios, and Bem Informática), on

Machado Meyer advised Indigo Group on the acquisition of a 44.39% stake in Administradora Geral de Estacionamentos (Indigo Brazil), previously held by Pátria Infraestrutura III, which was advised by Pinheiro Neto Advogados, making Indigo the

Stocche Forbes advised the company and Pinheiro Neto advised the underwriters on the issuance of Agribusiness Receivables Certificates (CRA) in four series of the 272th issuance of Virgo Companhia de Securitização, backed by Agribusiness

Stocche Forbes advised the issuer; Pinheiro Neto advised the underwriter on the 35th issuance of simple debentures, non-convertible into shares, of the unsecured type, in single series, for public distribution, under the rite of automatic