Veirano advised on the public offering of the 4th issuance of debentures by Ultrafértil, in the total amount of BRL 500 million, and the 8th issuance of debentures by VLI Multimodal, in the total amount

Tags :slider

Demarest advised Bloco de Onze Aeroportos do Brasil – BOAB, the Brazilian subsidiary of Aena, on its first issuance of simple debentures, non-convertible into shares, secured by real collateral, in the total amount of BRL 5,3 billion.

TozziniFreire acted as a Brazilian counsel to Eldorado Brasil Celulose on the issuance and sale of 8.500% senior notes due 2032 in the aggregate principal amount of USD 500 million, by the Eldorado Intl. Finance GmbH, guaranteed by

TozziniFreire advised Sparta, as the asset manager, in the 6th follow-on offering of Sparta Infra CDI Fundo de Investimento Financeiro em Cotas de Fundos Incentivados de Investimento em Infraestrutura Renda Fixa, pursuant to CVM 175 and

Veirano advised Cemig Distribuição on the public offering of simple, non-convertible debentures, in two series, of its 11th and 14th issuance, with personal guarantee provided by Companhia Energética de Minas Gerais – CEMIG. Mattos

Stocche Forbes acted as deal counsel in the public offering of the first issuance of debentures by Embraport – Empresa Brasileira de Terminais Portuários (from DP World group) in the total amount of BRL 2,115,400,000, 00 and

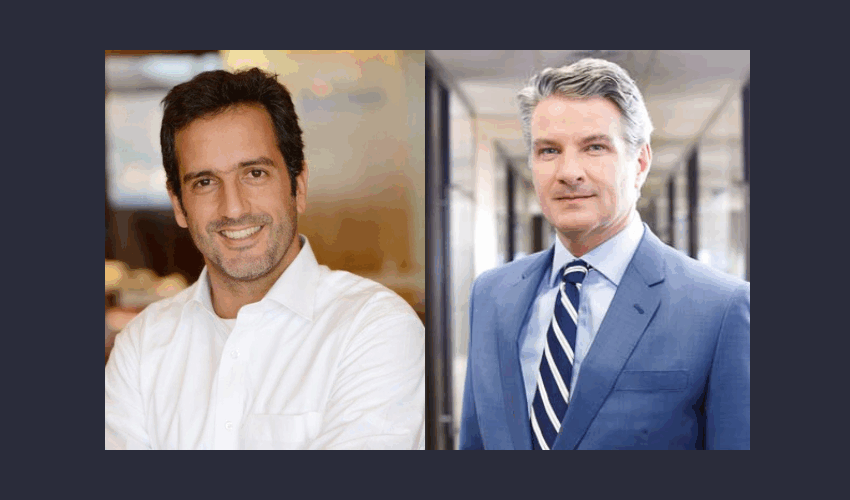

Zavagna Gralha Advogados advised Rebels Ventures, founded by the founders of Reserva, Cesar Villares 4M Holding, and Mário Chady, founder of Grupo Trigo, on The Simple Gym‘s BRL 2 million investment round. Rebels Ventures

TIM Brasil and the founders of V8.Tech entered into an agreement for the acquisition of 100% of the company’s equity. The transaction includes an upfront payment of R$ 140 million, with the possibility of up

FLH advised Camil Alimentos, as debtor, in connection with the 389th issuance, in four series, of agribusiness receivables certificates by Eco Securitizadora de Direitos Creditórios do Agronegócio, in the total amount of BRL 1.25

BMA advised Grupo Aeroportuario del Sureste (ASUR), one of the leading airport operators in the Americas, on the negotiations and contracts for the acquisition of 100% of the shares issued by Companhia de Participações em