US imposes sanctions on Mexican companies over Venezuela links

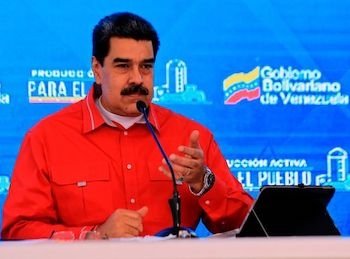

The US Treasury Department has imposed sanctions on two Mexican companies over their links to the regime of Venezuelan President Nicolás Maduro (pictured).

The two Mexican companies, Libre Abordo and Schlager Business, are among eight foreign companies targeted by the Treasury’s Office of Foreign Assets Control (OFAC) for their activities in or associated with a network allegedly attempting to evade US sanctions on Venezuela’s oil sector.

The two Mexican companies, Libre Abordo and Schlager Business, are among eight foreign companies targeted by the Treasury’s Office of Foreign Assets Control (OFAC) for their activities in or associated with a network allegedly attempting to evade US sanctions on Venezuela’s oil sector.

Libre Abordo and Schlager Business Group stand accused of helping Caracas evade US sanctions, in what is the first formal action by the US against Mexican firms involved in trading Venezuelan oil, according to media reports.

In a statement the US Treasury said, “though Libre Abordo and Schlager Business Group claimed to have contracts with the government of Venezuela to deliver corn and water tanker trucks to Venezuela, the two companies failed to deliver corn to Venezuela and sent approximately 500 water trucks (only half of what was contracted) at grossly inflated prices.”

“This does not match the amount of PdVSA crude oil that was lifted and re-sold by Libre Abordo and Schlager Business Group, valued in excess of $300 million.”

Mexican businessman Joaquin Leal Jimenez is also listed among those blacklisted by the Treasury.

“Since at least 2019, the illegitimate Maduro regime and PDVSA have cooperated with US-designated Alex Nain Saab Moran and Leal to evade US sanctions and assist in the sale of Venezuelan-origin crude oil,” the Treasury statement says.

“One of Saab and Leal’s recent schemes to sell Venezuelan-origin crude oil was under the guise of an “oil-for-food” program that never resulted in food deliveries to Venezuela. Saab and Leal, working with Mexico-based companies Libre Abordo and Schlager Business Group, brokered the re-sale of over 30 million barrels of crude oil on behalf of PdVSA, approximately 40% of PdVSA’s oil exports in April 2020.”