HD Legal has incorpored Alberto Vergara (pictured) as new director to head its Constitutional, Administrative law practice. Lawyer from the Catholic University of Chile, Master of Laws (LLM) from Northwestern University, USA, with more than 20

Tauil & Chequer Advogados in association with Mayer Brown, acted as deal counsel in the public offering of two series of shares of the first issue of the ICRED FGTS Fund. The offering was intermediated

Zavagna Gralha Advogados advised CTA Smart which received an investment of BRL 16 million, of which BRL 10 million from Invisto, which was advised by Madrona Fialho and BRL 6 million from Indicador, which was advised by BMA

Pinheiro Neto advised BTG on the acquisition of 100% of Serglobal Participações, the parent company of Sertrading group, an important player in foreign trade focused on import transactions, which was advised by Mattos Filho. The

Cescon Barrieu and Tauil & Chequer Advogados in association with Mayer Brown advised on the public offering of primary distribution of quotas of the first issue of the Real Estate Investment Fund JS Recebíveis

Pinheiro Neto Advogados advised the issuer, and Machado Meyer advised the lead underwriter on the 2nd issuance of simple debentures, not convertible into shares, in a single series, unsecured, with additional fiduciary guarantee, for public

CSMV Advogados announced Simone Vicentini (pictured), former Assistant Secretary for Prizes and Betting at the Ministry of Finance, as the new lawyer in the betting and sports area. After recently announcing the arrival of José

Machado Meyer advised Evergreen on the due diligence of Guarde Aqui and on the negotiation of the share purchase agreement and other covenants. Stocche Forbes advised the sellers, Guarde Aqui. The transaction increases the company’

Ayres Ribeiro Advogados announced the arrival of Guilherme Costa Val (pictured) as a new partner at the office in Belo Horizonte (MG), to strengthen the tax consulting practice. Costa Val graduated in Law from Faculdade

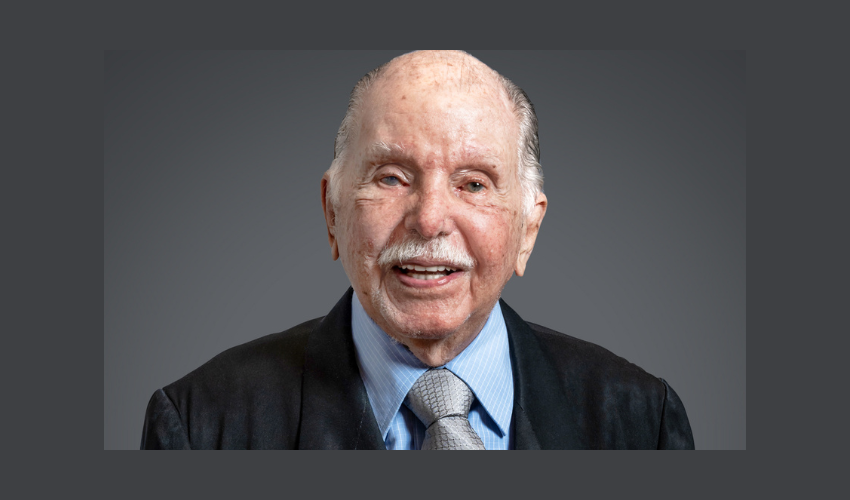

With heavy hearts, Villemor Amaral Advogados announced the death of Dr. Hermano de Villemor Amaral (son) (pictured), at the age of 104, in the early hours of Thursday morning (18/07), in the city of Rio de Janeiro.