Latin America M&A is in slow recovery: Fitch

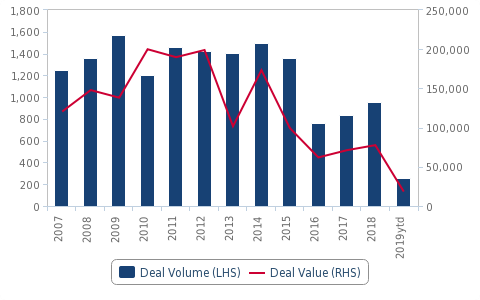

Latin American M&A activity “is slowly and steadily coming back to life after a fall from grace, which saw depleted deal levels reach their nadir in 2016,” according to a report by Fitch Ratings.

With economic growth accelerating once more across the region, and especially in Brazil, the region’s largest economy, commodity prices are continuing to enjoy upside, and with consumer spending trending higher, corporate boardrooms with acquisitive growth ambitions are gradually shifting their focus back towards Latin American markets once more, the report states.

With economic growth accelerating once more across the region, and especially in Brazil, the region’s largest economy, commodity prices are continuing to enjoy upside, and with consumer spending trending higher, corporate boardrooms with acquisitive growth ambitions are gradually shifting their focus back towards Latin American markets once more, the report states.

Brazil is key to the region, it states, and the country remains an attractive investment destination despite ongoing political uncertainty surrounding President Bolsonaro’s ability to pass pension and fiscal reforms amid a lack of support in congress. However, foreign direct investment inflows have been steady on the expectation that Brazil’s economy has turned the corner, and primary commodity prices are broadly supportive and economic policy is becoming more investor-friendly.

Fitch expects the Brazilian real to weaken over the coming quarters, with sentiment playing an outsized role in driving near-term volatility.

“The unit will face selling pressure as pension reform efforts disappoint investor expectations, leading to a repricing of Brazilian assets in light of a weaker growth outlook,” it states.

The currency’s depreciation could be “an acquisitive growth opportunity for inorganic growth for boardrooms from overseas that are more comfortable with risk owing to attractive asset prices in Brazil,” it added.

And across the region, economic recovery is expected to continue in 2019 and beyond, and more favourable consumer spending conditions will transpire, especially with low interest rates supporting demand for credit.

Fitch forecasts an acceleration in real GDP growth in the Latin America region of 2.2 per cent in 2019, up from an estimated 1.5 per cent in 2018, and it predicts economic growth to reach 2.7 per cent in 2020.

The graph shows Latin America’s annual announced M&A activity by deal value, in millions of US dollars, between 2007 and 2019.