Bruchou & Funes de Rioja provided legal counsel to JPMorgan Chase in negotiating the lease of a full office building within Centro Empresarial Núñez (CEN), a prestigious business hub in the northern corridor of

Tags :Bruchou & Funes de Rioja

Bruchou & Funes de Rioja and Muñoz de Toro Abogados have advised on the ARCOR’s issuance of Series 26 Notes for a nominal value of US$68,415,046 and its Series 27 Notes for a nominal

Bruchou & Funes de Rioja and Tavarone Rovelli Salim Miani have advised in the issuance of MSU’s Series XV Notes for a total of US$34,876,339. The 8.50% notes, issued on April 16, 2025, and maturing on

Marval O’Farrell Mairal and Mayer Brown have advised Petronas Carigali Canada and Petronas Carigali International in the sale of PETRONAS E&P Argentina (PEPASA) to Vista Energy and Vista Argentina, which were counseled

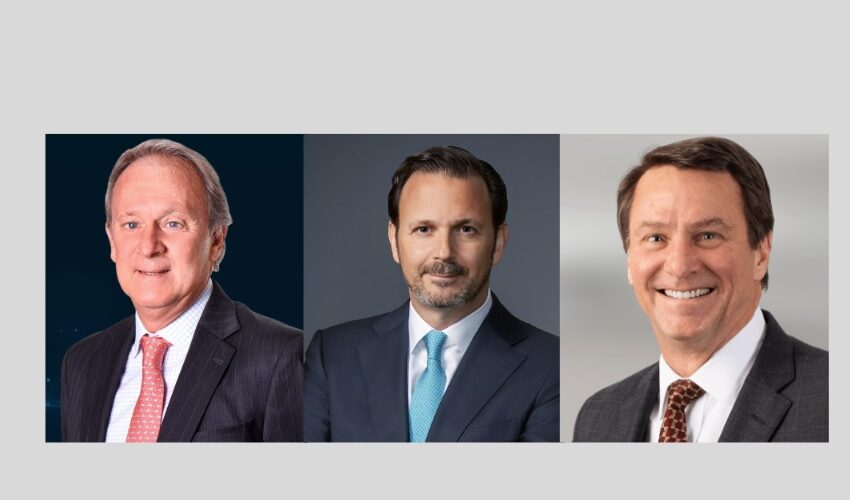

Bruchou & Funes de Rioja, one of Argentina’s leading law firms, has announced the appointment of Leandro Exequiel Belusci (pictured right) and Pablo Crimer (pictured left) as new partners, effective April 1, 2025. These promotions reinforce

DLA Piper Argentina and Bruchou & Funes de Rioja have acted on the issuance of debt securities by the Province of Mendoza. The transaction, which took place on March 20, 2025, involved the issuance of two classes

Bruchou & Funes de Rioja has guided Banco de Valores (VALO) inaugural issuance of Class 1 notes. The issuance, valued at US$30 million, marks a significant milestone for VALO under its recently established global note issuance

Bruchou & Funes de Rioja and Beccar Varela have advised Vista Energy Argentina (Vista) the issuance of Class XXVIII simple, non-convertible notes. The transaction raised a nominal amount of US$92,413,570 under Vista’s Global Program

Dias Carneiro Advogados advised IDB Invest on a corporate finance in the amount up to USD 14,200,000 to the Brazilian and Chilean subsidiaries of Promedon Group, namely Promedon do Brasil Produtos Médico Hospitalares and Productos

Bruchou & Funes de Rioja and TCA Tanoira Cassagne have advised on Petroquímica Comodoro Rivadavia issuance of Class S Notes worth US$65 million under the “Frequent Issuer Simplified Regime” (Régimen de Emisor Frecuente).