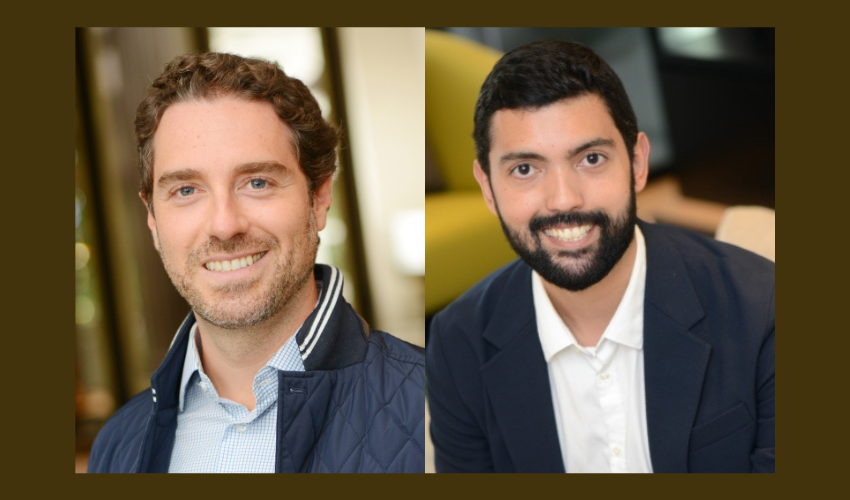

Bronstein Zilberberg advised Airborne in the investment round with capital injection of undisclosed value, in brazilian fintech VIPe that announced the conclusion of its first investment round, raising BRL110 million. Bronstein, Zilberberg, Chueiri e Potenza Advogados advised Airborne and relied on partners Guilherme Potenza (pictured left) and Alfredo Neri (pictured right) and associate Victoria Auada.

GVBG | Gentil Monteiro, Vicentini, Beringhs e Gil Advogados advised MDS Brasil on the acquisition of Unificado, a broker specializing in the advisory sales of insurance programs for legal entities, which was advised by PSQA Advogados.

Machado Meyer advised Care Plus, controlled by the British company Bupa on the acquisition of 100% of the equity participation of INPAO – a company which operates dental care plans throughout Brazil, which was advised by Demarest.

Veirano Advogados, in partnership with italian firm Pedersoli, advised Goglio on the acquisition of 51% of Mega Embalagens, with headquarters and production plant in Salvador do Sul, State of Rio Grande do Sul. DSF advised the

The Brazilian transactional market registered a total of 868 transactions and moved BRL 91.4bn in the second quarter of 2023. In the second quarter of 2023, 416 mergers and acquisitions were recorded, between announced and completed, and a total

Several firms have advised on a deal between Telefónica Hispanoamérica, KKR and Entel Perú, through which KKR acquired 64% of fibre optic wholesaler PangeaCo as well as the existing fibre optic networks of Telefó

Machado Meyer Advogados advised on the transaction which Grupo Pão de Açúcar (GPA) announced the segregation of its business and that of Almacenes Éxito, a company based in Colombia. The transaction, valued at

Stocche Forbes and FLH advise on a M&A transaction involving the acquisition by Ativa (a portfolio company of funds managed by Prisma Capital) of an equity interest in Data Lawyer, one of the

TozziniFreire Advogados announced two new partners: Cristina Rangel Maciel (pictured right) and Rodrigo de Grandis (pictured left), who join the mergers & acquisitions and white-collar crimes teams, respectively. With 15 years of experience, Cristina has a

Latham & Watkins has assisted Patria Investments in a joint venture agreement with Bancolombia to expand its real estate capabilities. Posse Herrera Ruiz also advised Patria, locally, while Sullivan & Cromwell and Philippi Prietocarrizosa Ferrero