Carey has assisted Agroveen Agricultural, a Nuveen (TIAA) company, an agricultural asset management business, in the due diligence, structuring and negotiation for the acquisition by Río King of three productive farms of more than 380

Garrigues has represented Percent Technologies (formerly known as Cadence Group), as an investor, in a $10 million USD securitization bond financing in favor of Leasy, a Peruvian car rental fintech, advised by Rebaza Alcázar &

The lawyer and professor Leandro Mello Frota (pictured), founding partner of Leandro Frota Advogados had his name approved to join the team of arbitrators of CBMA – (Centro Brasileiro de Mediação e Arbitragem) Brazilian Center

Machado Meyer Advogados advised Irani Papel e Embalagem on public offering of agribusiness receivables certificates from the 194th issue of Eco Securitizadora de Direitos Creditórios do Agronegócio, backed by agribusiness credit rights owed

Carneiros e Dipp Advogados, based in Brasília, and Cruz Vilaça Advogados, based in Lisbon, Portugal, have entered into a collaboration agreement aimed at offering clients high-quality legal services in Brazil and the European

Cleary Gottlieb has counselled Credit Suisse, as letter of credit provider, on the acquisition in favour of Saavi Energía of Tierra Mojada, from the Spanish company Fisterra Energy and Blackstone. The Letter of Credit

Beccar Varela has advised Tarjeta Naranja, as issuer, and Banco de Galicia y Buenos Aires, as arranger and underwriter, in the issuance of its Class LVI simple, non-convertible into shares, unsecured Negotiable Obligations for a

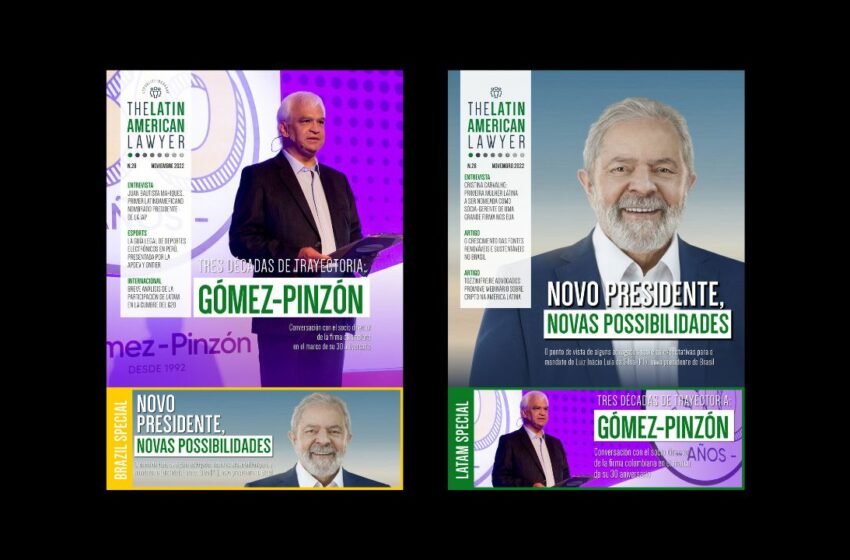

The Latin American Lawyer November issue is now available for free download. We are approaching a big change in Latin America with governmental changes, especially in Brazil with the recent election of Lula da Silva.

Carey has represented Corporación Nacional del Cobre (Codelco) in the amendment and recast of a Power Purchase Agreement (PPA) entered into with Colbún to supply renewable energy for Codelco’s total consumption, including

Demarest Advogados advised L Catterton, a private equity fund, on a significant minority equity investment in Cantu Store, which is a leading importer and distributor of tires in Brazil. The transaction value was BRL 600 million.