Stocche Forbes advised BR Malls Participações and Allos; Cescon Barrieu advised Itaú BBA Assessoria Financeira and XP Investimentos Corretora de Câmbio, Títulos e Valores Mobiliários on the public distribution offering of

Tags :Stocche Forbes

Stocche Forbes advised Banco Santander (Spain), exclusively in regards to aspects related to brazilian law, in the constitution of a fiduciary assignment governed by brazilian law given in guarantee of a cross-border finacing in the

Stocche Forbes Advogados advised SABESP; Lobo de Rizzo acted as counsel of the underwriters in the 33rd issuance of simple unsecured debentures, non-convertible into shares, in three series, with firm guarantee of placement, pursuant to

Lefosse advised Vibra Energia and Stocche Forbes acted as legal advisors to the Itaú BBA Assessoria Financeira on the public offering of debentures of Vibra Energia in the ninth issuance, pursuant to CVM 160, in the

Stocche Forbes advised NE Logistic Fundo de Investimento Imobiliário, real estate investment fund managed by XP Investimentos, on the transaction involving the sale of the Warehouse G01, part of the logistic condominium Cone Multimodal 02,

Stocche Forbes assisted HSI Gestora de Real Estate Private Equity in the acquisition of the property where the Vera Cruz Hospital is located, in the city of Campinas, state of São Paulo. Hospital Care

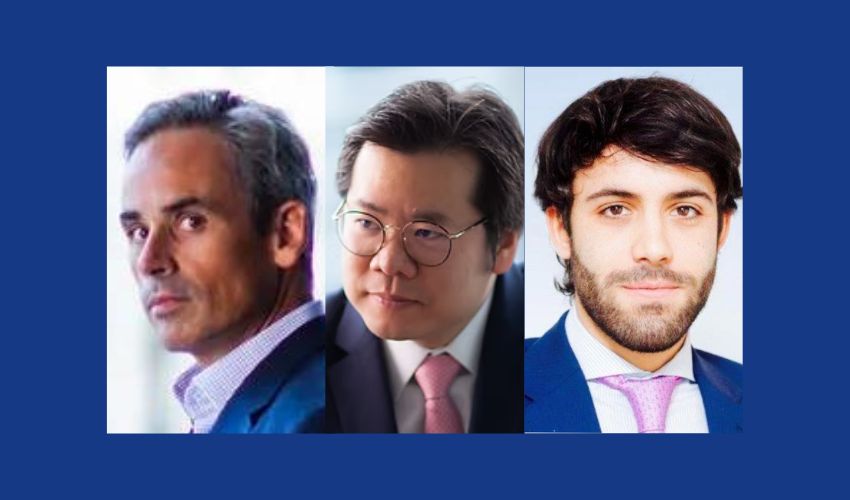

Stocche Forbes Advogados has announced the promotion of seven new partners in different strategic areas, reflecting the firm’s commitment to organic growth in key sectors for the national and international markets. In the infrastructure

Stocche Forbes and Lefosse advised on the public offering of the 5th issuance of debentures by Transnorte Energia, pursuant to CVM 160, in the total amount of BRL 700 million. Stocche Forbes advised Transnorte Energia and relied

Stocche Forbes acted as deal counsel in the public offering of senior-class and subordinated-class real estate receivables certificates (CRI), from the 246th issuance of real estate receivables certificates by Virgo Securitization Company, backed by real

Stocche Forbes and Lobo de Rizzo advised on Usina de Energia Fotovoltaica Pedro Leopoldo issuance of its 1st series of non-convertible commercial notes, for public distribution pursuant to CVM 160, in the total amount of BRL 260