TozziniFreire Advogados advised BB Ventures I Fundo de Investimento em Participações Multiestratégia Investimento no Exterior (Banco do Brasil’s investment fund) on investment in the amount of BRL 10,500,000.00 in P4 Holdings Pty, owner

Tags :TozziniFreire

TozziniFreire Advogados advised on the acquisition of 100% of the quotas of Ponto Predict Sistemas by Worc Technologies, a startup specialized in technology solutions for employers. TozziniFreire advised Worc Technologies Holdings and relied on partners Juliana

TozziniFreire Advogados advised Groupe BBL that has completed another international transaction with the acquisition of the Nethelands’ Share Logistics group, an international freight forwarding services provider, predominantly active in the field of air and ocean

TozziniFreire has acted as a special Brazilian counsel to Wells Fargo, as a collateral agent for the benefit of itself and the lenders, in connection with the ABL Credit Agreement executed on August 18, 2022, entered into

TozziniFreire Advogados acted in the acquisittion by PwC Strategy & do Brasil Consultoria Empresarial (PwC) of 100% the shares of AgTech Garage Fomento e Investimentos (AgTech), sold by vendors CHAAC Participações and DREI Zinnen Participaçõ

TozziniFreire Advogados advised Fundo de Investimento em Participações RX Ventures Multiestratégia (Renner’s investment fund) in its investment in Credit Vista Technologies Limited, owner of Credit Vista Tecnologia para Finanças Pessoais Eireli (

TozziniFreire Advogados advised Urca Capital on the acquisition of quotas issued by Yuca Empreendimentos Imobiliários SPE XI, for the development of real estate project Augusta Park. TozziniFreire Advogados advised URPR11 Investimentos em Desenvolvimentos Imobiliá

TozziniFreire Advogados advised FRAM Capital, as lead coordinator, and Gaia, as issuer, on the public offering with restricted distribution efforts, and private placement of simple debentures, non-convertible into shares, of the subordinated type, in 2 (two)

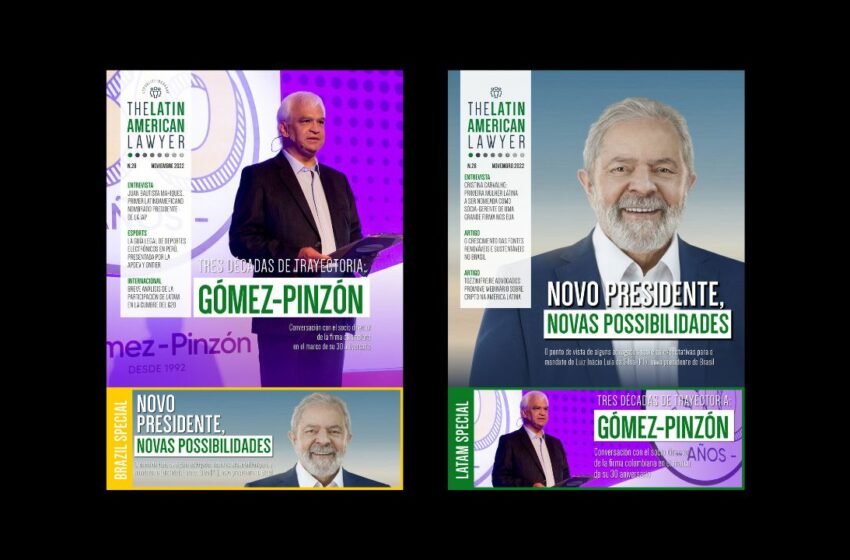

The Latin American Lawyer November issue is now available for free download. We are approaching a big change in Latin America with governmental changes, especially in Brazil with the recent election of Lula da Silva.

TozziniFreire Advogados advise Nomad on acquisition of Husky and contribution by Husky’s quotaholders of part of Husky’s quotas into Nomad. As consequence, Husky became fully owned by Nomad. The transaction marks the consolidation