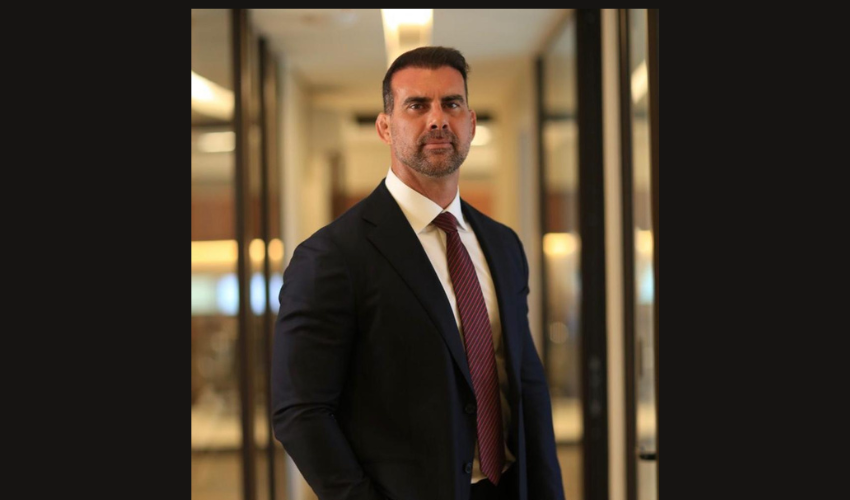

Carneiros Advogados has announced the arrival of partner Sergio Moraes (pictured), who will take over the firm’s new Healthcare area. With extensive experience in the health area, Sergio is the legal director of the

Modesto Carvalhosa, Kuyven e Ronco Advogados (MKR Advogados) has announced the promotion of Kaue Cardoso de Oliveira (pictured) to partner. With more than seven years’ experience at the firm, Kaue specializes in business law, with

Toledo Marchetti Advogados has announced Carlos Eduardo Leal de Carvalho (pictured) as the firm’s new equity partner. With more than 20 years’ experience in insurance law, Carlos Eduardo works throughout the entire cycle of contracting,

Pinheiro Neto advised George Holding, a company owned by funds managed by CVC Capital Partners, on the acquisition of 98.5% of the share capital of GSH, held by Rede D’Or São Luiz, which was

Lefosse acted alongside Goodwin Procter LLC as Brazilian counsel of Teleflex Incorporated on the acquisition of substantially all of the vascular intervention business of BIOTRONIK SE & Co. KG. for an estimated cash payment on

Demarest advised GEF on the acquistion of equity interest in Leveros from 2BCapital, from Bradesco group. The transaction value was not disclosed. Demarest advised Gef Latam Climate Solutions and relied on led partner João

Pinheiro Neto Advogado advised BTG Pactual on the acquisition of JGP Gestão Patrimonial. BMA advised the sellers and the shareholders. The consummation of which is subject to the required antitrust and regulatory approvals and

Stocche Forbes Advogados and Lobo de Rizzo advised on the 12ˢᵗ issuance of simple unsecured, non-convertible debentures, for public distribution, under automatic registry procedure, pursuant CVM Resolution 160, with firm guarantee of placement, by Vert Companhia Securitizadora.

Pinheiro Neto advised the issuer Brasil Tecnologia e Participações (Braasil TecPar) and Tauil & Chequer Advogados, in association with Mayer Brown advised the underwriters BTG Pactual Investment Banking; Banco Santander (Brasil) and Banco Daycoval,

Bichara Advogados advised B.Side Investimentos, Virgo Companhia de Securitização and Antonio Maria Empreendimento Imobiliário SPE (Residencial Antonio Maria), on the issuance of Real Estate Receivables Certificates (CRIs), which constituted the 245th issuance