Pinheiro Neto Advogados acted as special Brazilian counsel to Planeta Securitizadora (issuer), and to the advisors and structuring entities Sustainable Investment Management (SIM) and Traive in the first Green CRA Issuance denominated in US dollars (

Bruchou & Funes de Rioja has advised Petroquímica Comodoro Rivadavia in the placement of Class I and J Notes for an aggregate nominal amount of AR$6,000,000,000,000 issued under the Simplified Frequent Issuer Regime. Tanoira

Barros & Errázuriz has advised the Del Río family on the deal to combine Derco with Inchcape plc in a transaction estimated at $1.57 billion USD. The transaction is subject to approval by regulatory

FLH Advogados advised Barentz International, a global life sciences group, on the acquisition of Volp Indústria e Comércio, a Brazilian player with leading presence on the personal care distribution sector. The acquisition was

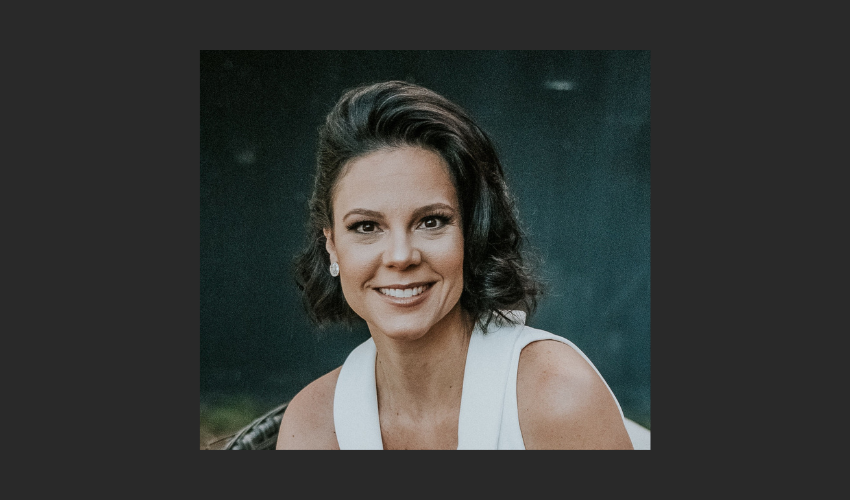

Patricia Forster (pictured) is the new Legal Operations Manager at Viseu Advogados. She will work closely with clients and legal departments in the development of management and technology projects. Patricia has 15 years of professional experience

Lobo de Rizzo advised Banco Itaú BBA on the 131st issue, in a single series, of CRA – Agribusiness Receivables Certificates, for public distribution with restricted efforts, of Virgo Companhia de Securitização, backed by agribusiness

Cleary Gottlieb has represented the Republic of Guatemala in its offering of 5.250% Notes due 2029 under Rule 144A/Reg S for $500,000,000 USD. The transaction was priced on 3 August and is expected to settle on 10 August. Santander

After opening Casa LDCM in Ipanema (RJ) in early 2022, LDCM Advogados has expanded its São Paulo team and its practice area with the arrival of new partner Tatiana Flores. Tatiana arrives to expand the

Chilean law firm Allende Bascuñán & Cía. has announced the promotion of Mauricio Carloza and Michael Camus as new partners of the firm. Mauricio (pictured left) has been part of the firm since 2020,

Morgan & Morgan has assisted Mercantil Holding Financiero Internacional in its $100,000,000 USD corporate bond registration with the Superintendencia de Mercado de Valores of the Republic of Panama. This transaction was done in order for the