Pérez Alati Grondona Benites & Arntsen has announced the promotion of Facundo Fernández Santos from the Tax department, as well as the addition of Geraldine Moffat to the Labour and Employment practice, as

Tags :Argentina

Bruchou & Funes de Rioja has advised the dealer managers and local placement agents in the exchange procedure, by Arcor, of its outstanding class 9 notes at a fixed interest rate equal to 6.000% maturing in 2023, for

Beccar Varela has advised Tarjeta Naranja, as issuer, and Banco de Galicia y Buenos Aires, as arranger and underwriter, in the issuance of its Class LVI simple, non-convertible into shares, unsecured Negotiable Obligations for a

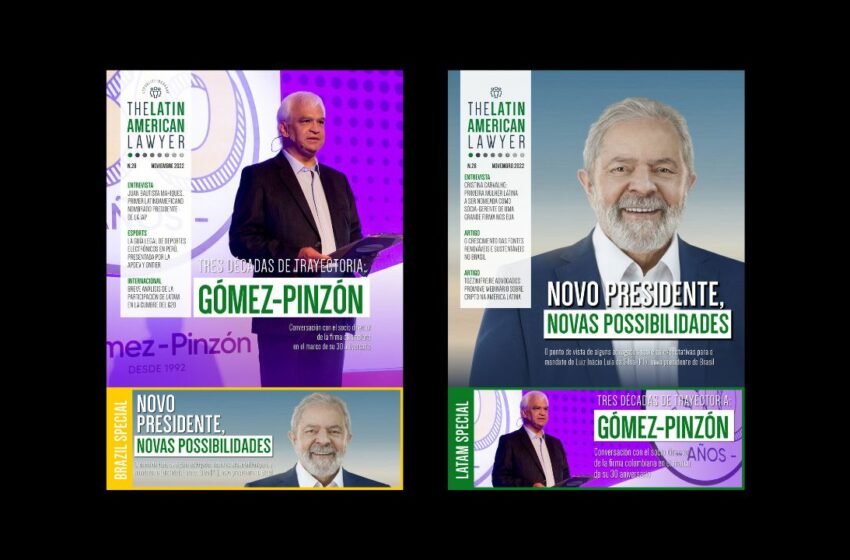

The Latin American Lawyer November issue is now available for free download. We are approaching a big change in Latin America with governmental changes, especially in Brazil with the recent election of Lula da Silva.

Bruchou & Funes de Rioja has assisted the lenders, arrangers, bookrunners and administrative agent in a loan agreement under New York law granted to Tecpetrol in the amount of US $300,000,000. The proceeds will be used

Beccar Varela has announced the opening of its new Public Affairs department, led by senior lawyer Camila Corvalán (pictured), specialist in government relations, antitrust and international trade. The new department’s main objective is

Tavarone Rovelli Salim & Miani has counselled Generación Mediterránea and Central Térmica Roca in their co-issuance of their Class XVII, Class XVIII and Class XIX Notes. Bruchou & Funes de Rioja has

Pérez Alati Grondona Benites & Arntsen has assisted the underwriters in the issuance of zero-rate dollar-linked notes of CNH Industrial Capital Argentina, integrated in kind through the delivery in exchange of Class 1 Notes, for

Pérez Alati Grondona Benites & Arntsen has advised on the issuance of the fourth Series of Trust Securities denominated “Tarjeta Fértil XIX” Classes A, B, and C for a total amount of $308,830,049 Argentine

Multiple firms have counselled on MSU Energy’s issuance of Class VI notes with a face value of US $ 45,593,670, dated 2 November 2022. The Notes were denominated, integrated and payable in US dollars, with public registration in