Tanoira Cassagne Abogados has represented Latin América Postal, as issuer, and Banco Mariva and Banco Supervielle as placement agents, in the issuance of Series I Secured SME CNV Negotiable Obligations for a total amount

Tags :Argentina

Tanoira Cassagne Abogados has represented ALZ Semillas, as issuer, Banco Itaú Argentina, as arranger and placement agent, and Itaú Valores as placement agent, in the first issue of ALZ Semillas under the Guaranteed Debentures segment

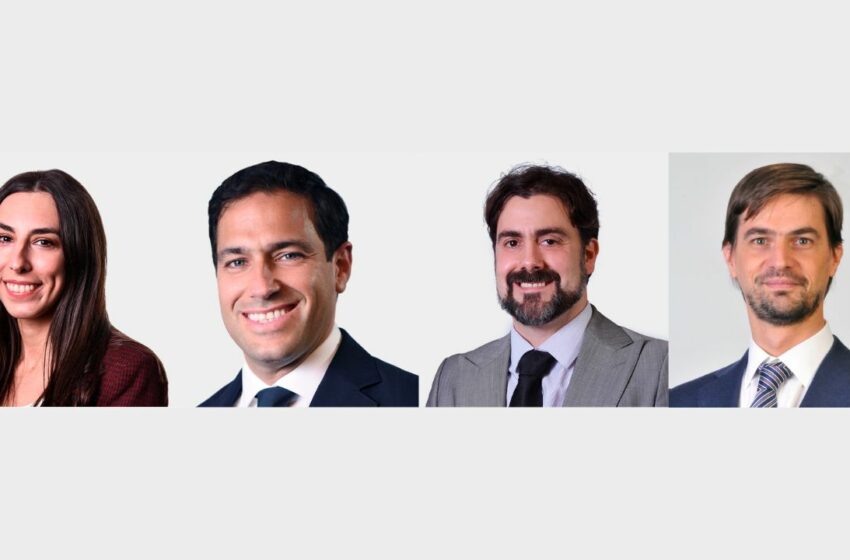

Marval O’Farrell Mairal has announced the appointment of Agustina M. Ranieri, Francisco Abeal, Fernando M. Alemany and Eugenio Hoss as new partners of the firm, to strengthen the practice areas in which they are

Tanoira Cassagne Abogados has advised Credicuotas Consumo in the issuance of its Series II Class 1 and 2 Notes for a face value of US$3,000,000,000. The issuance was made under its Global Programme of Negotiable Obligations for

Beccar Varela has counselled Tarjeta Naranja, and the arranger, in its issuance of simple, non-convertible into shares, unsecured Class LV Negotiable Obligations, carried out in two series, for an aggregate nominal value of $17,109,771,560 Argentine pesos.

Cleary Gottlieb has represented Pampa Energía in its offer to exchange any and all of its outstanding 7.375% Notes due 2023 for newly issued 9.500% Notes due 2026 and certain cash consideration, as applicable. The exchange offer was

Tanoira Cassagne Abogados has counselled in the issuance of Treasury Bills Series III Classes 1, 2 and 3 of the Province of Tierra del Fuego, maturing on August 26, 2022, September 30, 2022 and November 23, 2022, respectively, for a total amount of AR$2,579,500,000.

Tavarone Rovelli Salim & Miani has advised MSU Energy on its issuance of US$15,100,000 par value Class V notes. Bruchou & Funes de Rioja has advised the arrangers and underwriters. The notes, issued on 22 July

Bruchou & Funes de Rioja has advised Petroquímica Comodoro Rivadavia in the placement of Class I and J Notes for an aggregate nominal amount of AR$6,000,000,000,000 issued under the Simplified Frequent Issuer Regime. Tanoira

Tanoira Cassagne Abogados has counselled the Province of Río Negro in the issuance of public debt securities “Bono Río Negro Serie II”. Bruchou & Funes de Rioja has counselled the lead arranger and