Demarest Advogados advised Corteva on the acquisition of the global business of Stoller Group. The transaction value was BRL 1,2 billion and involved more than 16 jurisdictions and the closing is subject to compliance with customary precedent

Tags :slider

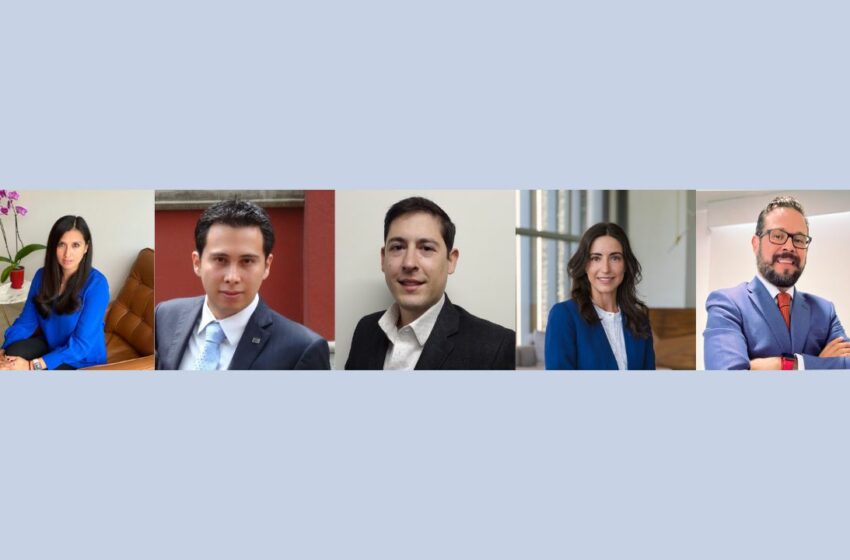

Carey has announced the appointment of 4 new partners to strengthen its litigation and environmental practice areas, with the addition of Mónica Pérez, Roberto Villaseca, Julio Recordon and Manuel José Barros. Mónica Pé

Mattos Filho advised Canada Pension Plan Investment Board (CPPIB) and Pinheiro Neto Advogados advised BTG Pactual Infraco Master Fundo de Investimento em Participações Multiestratégia and V.tal Rede Neutra de Telecomunicações in

Machado Meyer Advogados announced the arrival of eight new partners. The new functions, which are effective as of January 2023, include (pictured top line from left to right): Alessandra Takara, Luiz Eduardo Miranda Rosa, Luís

TozziniFreire Advogados acted in the acquisittion by PwC Strategy & do Brasil Consultoria Empresarial (PwC) of 100% the shares of AgTech Garage Fomento e Investimentos (AgTech), sold by vendors CHAAC Participações and DREI Zinnen Participaçõ

Gómez-Pinzón celebrates 30 years of transcending through advising its clients. The Latin American Lawyer celebrates the firm that has positioned itself among the best in Colombia in areas such as M&A and

Mattos Filho advised Administratora Fortaleza on the sale of control of Conglomerado Financeiro Alfa to Banco Safra, wich was advised by Pinheiro Neto Advogados. The transaction involved the sale of control of the listed companies

Chevez Ruiz Zamarripa has announced the promotion of seven new partners, effective 1 January 2023: Aline Espinosa and Anthar González in the Tax practice, Marco Antonio de la Fuente in the Wealth practice, Diego Marván

TozziniFreire Advogados advised Urca Capital on the acquisition of quotas issued by Yuca Empreendimentos Imobiliários SPE XI, for the development of real estate project Augusta Park. TozziniFreire Advogados advised URPR11 Investimentos em Desenvolvimentos Imobiliá

Tauil & Chequer Advogados associated with Mayer Brown assisted BNDES in structuring the privatization of Ceasaminas, a mixed economy company of the federal government, supervised by the Ministry of Agriculture, which operates in the commercialization